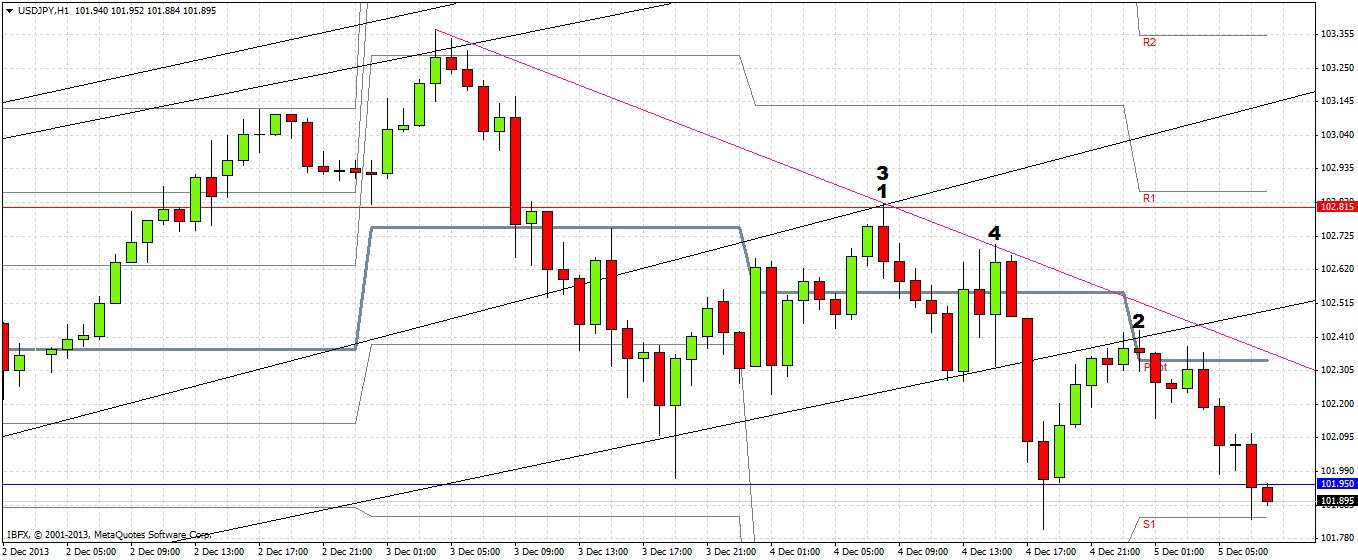

Today’s USD/JPY Signal

Risk 0.50%

Entry should be made between 8am and 11am today, or from 2pm today to 8am tomorrow morning London time only.

Entry should not be made after the price has touched the lower bullish ascending trend line in the chart below.

Enter short at the next bar break break of a pin, strong engulfing or outside bar rejecting the bearish descending trend line marked in pink in the chart below.

Stop loss at the local swing high.

Take enough profit at 101.95 to remove the risk from the trade, or by 1pm London time in any case. Take 50% of the remainder of the position as profit when the price touches the lower bullish trend line, and leave the rest, consider closing it out before the weekend if it lasts.

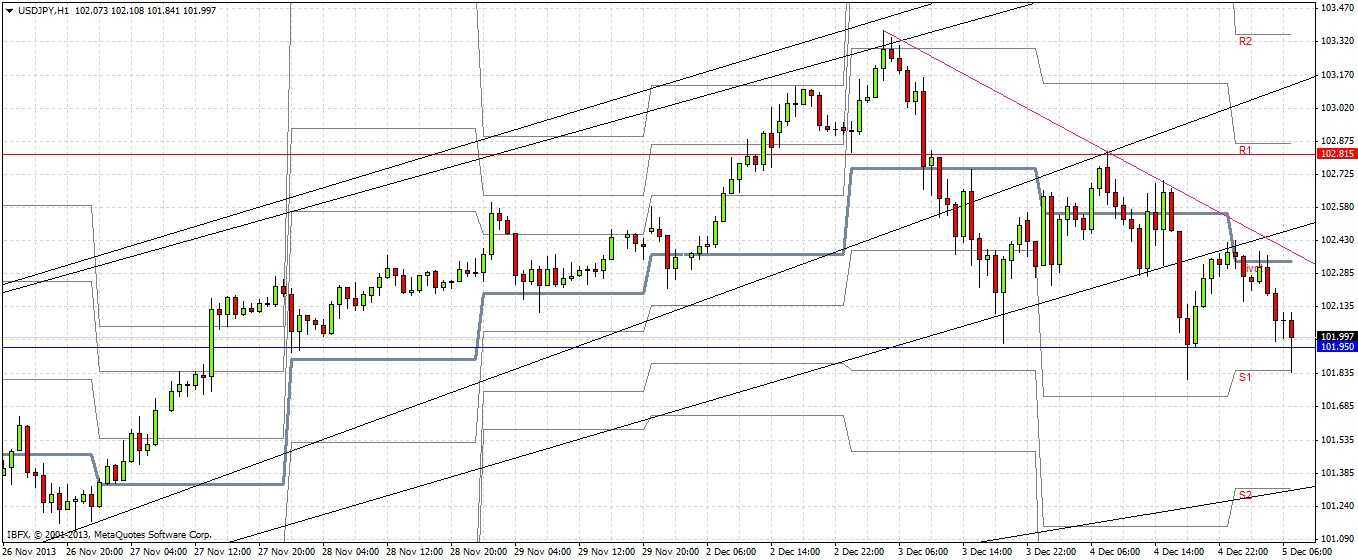

USD/JPY Analysis

There are important news items due later today for the USD at 1:30pm London time. Unfortunately, although we mentioned yesterday the possibility of going short at a rejection of the broken trend line at 102.81 confluent with a possible support turned into resistance level, we did not give it as a signal. This would have been a good short trade. The past few days have given me several reasons to take a bearish bias:

1. The daily chart printed a bearish outside bar closing in its bottom quarter on Tuesday. This was broken to the downside yesterday. Statistically such bars have about a 60% chance of producing a move down, so we are likely to see 101.00 before we next see 103.37.

2. We have broken and rejected retests from 2 bullish trend lines, marked at (1) and (2) in the chart below.

3. We have established support turned into resistance at 102.82, marked as a red horizontal line in the chart below.

4. We have a new bearish trend line that is holding and has been unsuccessfully tested twice, marked at (3) and (4) in the chart below.

5. At the time of writing, the support level of 101.95 looks like it is being broken down. If this fails to hold, the price should get to the lower bullish trend line.

A word of caution: the USD data could make anything happen, so any short trades should be taken and protected either quickly, or after 2pm London time.