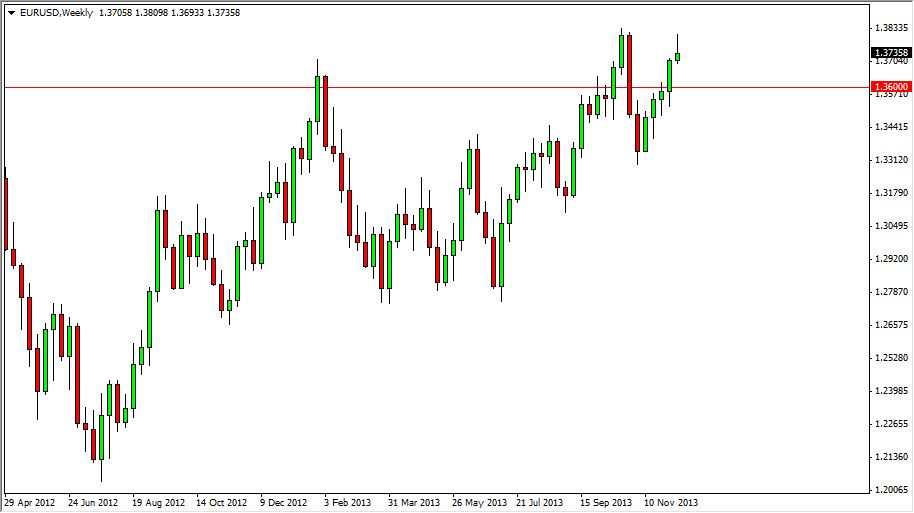

EUR/USD

The EUR/USD pair rallied most of the week, but as you can see, struggled to get above the 1.38 level. The pullback caused a shooting star to happen, and because of this I expect the market to pull back even farther. The 1.36 level below should be supportive, but I could also see the possibility of a move as low as 1.33 if we get below that aforementioned 1.36 support area. The end of the year could also cause a few liquidity issues, so perhaps we just chop sideways. In the end, I think we will eventually find buyers to push this market to the 1.40 level. The question now is whether or not we pullback first.

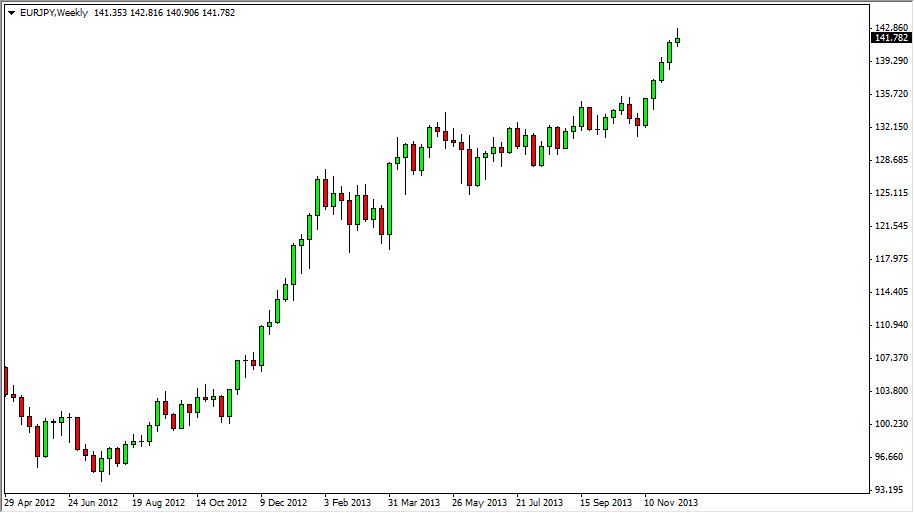

EUR/JPY

The EUR/JPY pair did much the same thing as the EUR/USD pair. The market failed to keep the gains above the 142 level, and formed a shooting star. This shooting star says that the market could very well pull back to find support. The 135 level below is the “floor” as far as I can tell in this pair. It is the end of the year though, so I think that the market could simply grind lower instead of falling. I am a buyer anywhere lower than current pricing, and a break of the top of this candle also is a reason to go long as well.

GBP/USD

The GBP/USD pair rallied during the bulk of the week, but pulled back from the 1.6450 area, an area that continues to show signs of resistance. This pair is very bullish overall, so I am not selling – no matter if there is a shooting star or not. I see significant support potential at the 1.62 level, the site of the most recent breakout. This pair should continue to go higher, but only after the New Year in my opinion. This market is blocked by the 1.65 level as far as I can tell, so I am buying a supportive candle lower, or a break above that level.

USD/JPY

The USD/JPY pair went back and forth during the week, settling on an almost neutral candle. This candle shows that the market could struggle to go higher, but the market is overly bullish. The 103 level has been resistive in the past, so the fact that we failed isn’t a big surprise. However, I think any pullback is an invitation to start buying. I still think a move higher reaches 105, and then eventually 110.