EUR/JPY

The EUR/JPY pair rose over the course of the last week, and I think this pair has finally broken out even harder, as the 145 level was tested. However, this market will more than likely pullback first as the liquidity of the markets will suffer with the New Year holiday in the middle of the week. This market should offer support below though, and because of this I am looking to buy, but at lower levels.

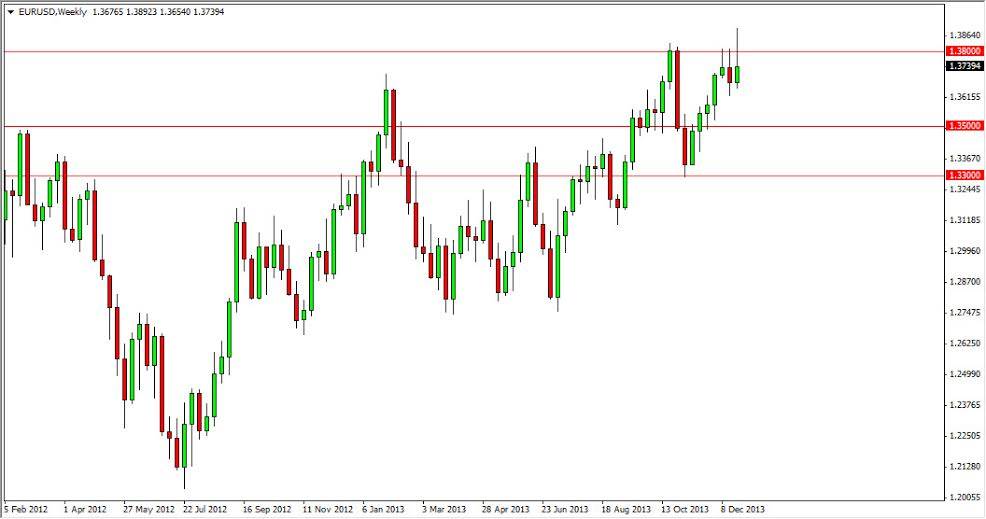

EUR/USD

The EUR/USD pair tried to break out to the upside during the week, but saw the 1.38 level offer far too much resistance to be overcome. This market should continue to grind its way higher, but I think that the lack of liquidity will continue to hinder the buyers at the 1.38 for the time being. Ultimately, I believe that the 1.40 level will continue to be the overall target, and will be reached in January. The selling of this pair isn’t in the cards for me at the moment, but could be later. The Euro continues to be a bit stronger, and I have to say that the shooting star that showed up was a result of illiquid conditions on Friday. Because of this, I am not overly worried about a selloff at this point.

USD/JPY

The USD/JPY pair broke higher during the week, and has now closed above the 105 level. If you have been reading my articles, you know that was a target of mine. I am now confident that this pair is heading to the 110 level, but it could see a bit of a pullback between now and then in order to collect more buyers. The market should offer plenty of buying opportunities going forward, mainly in the form of pullbacks. This is the beginning of a long-term uptrend in my opinion. In fact, I am keeping a “core position” in this market, and planning on holding onto it for months, possibly years.

USD/CAD

The USD/CAD pair fell initially for the week, but bounced off of the 1.06 level as you can see. In the end, the market formed a hammer, and closed just above the 1.07 level. This area is the key for higher levels, and I think that if we can break above the recent high in this pair – the market will head towards the 1.10 level. Selling isn’t an option, and I think this pair is going to be one of the better performers for the first quarter of 2014.