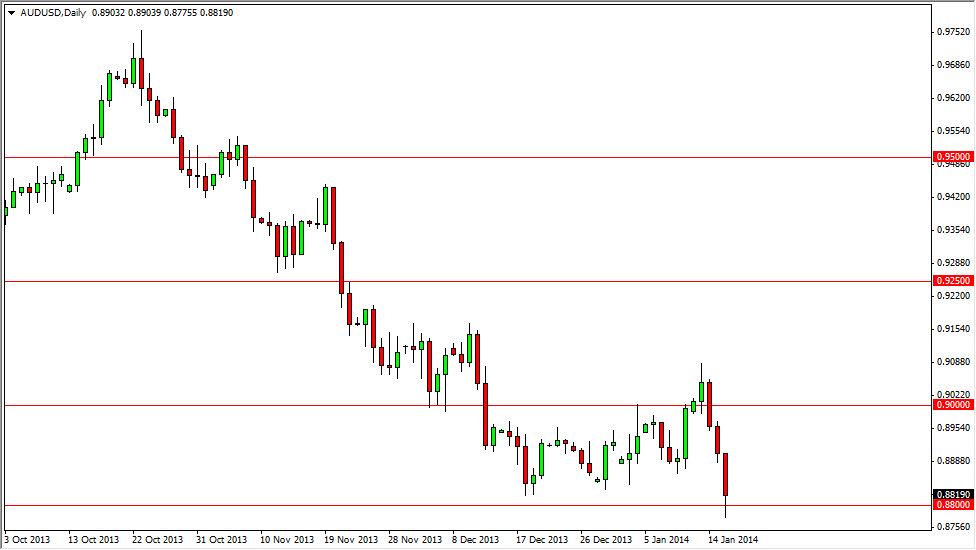

The AUD/USD pair fell during the session on Thursday, and at one point time even managed to get below the 0.88 handle, an area that I have been watching for significant support. I have said recently that I believe a daily close below that area would in fact signal new selling, and a potential breakdown in the Australian dollar. Although we did get below that level, we could not close below there, so I think the last vestiges of support are holding on.

That being said, we still only closed about 20 pips above that level. Because of this, I don’t feel that the support for long, and it’s only a matter of time before we break down now. The sets up an interesting scenario, as we could sell rallies from a short-term perspective, or perhaps sell a break of the lows from the Thursday session as it would signify that the stop loss orders down there have been cleared out.

Gold and the Australian dollar.

Never forget that the gold markets and the Australian dollar tend to run hand-in-hand. If the gold markets start to fall apart, so what is currency pair. However, a lot of this could come down to the strength of the US dollar in general, and basically ignore what’s going on in Australia itself. Also, you have to keep in mind that the Australian dollar is highly sensitive to the Asian economies, and whether or not they are importing raw materials.

With that in mind, keep an eye on Chinese economic numbers to determine the future direction of the Australian dollar. Right now, Chinese numbers are fair, but hardly strong. All things being equal, I believe that this pair will more than likely bounce from here, but offer a nice selling opportunity. The 0.90 level should be especially resistive, and I would be all over a short trade at that level if we got the right resistant candle. As far as buying is concerned, I really don’t have a scenario in which I’m comfortable doing so at the moment, but would consider it above the 0.9250 level.