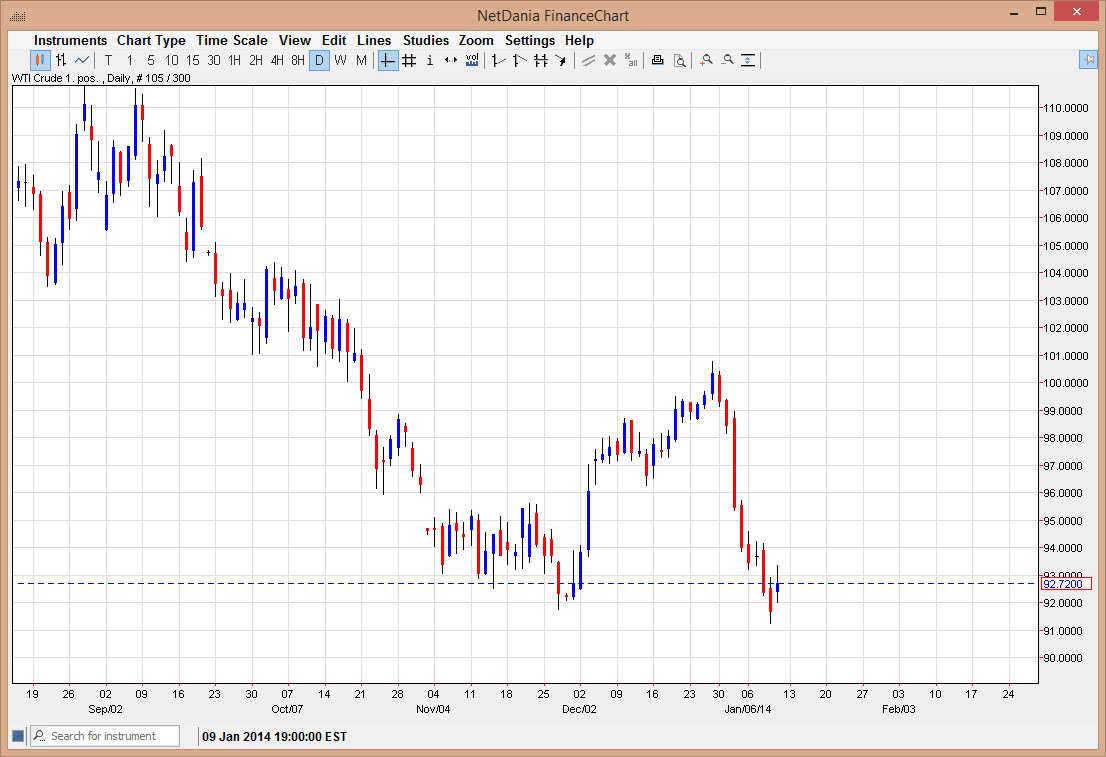

The WTI Crude Oil markets rose during the session on Friday, but as you can see the markets gave back quite a bit of gains by the time the market close. This is probably because of the nonfarm payroll numbers come out so weak. That being the case, the market formed a shooting star, which suggests that perhaps we are going to continue going lower. This makes sense, because if the employment situation in the United States is somewhat poor, it’s hard to imagine that there is going to be massive demand for energy out of the nation’s large factories or heavy industry in general.

Because of all this, I feel that this market will continue to drift lower, but the $90 level should offer a significant amount of support based upon longer-term charts. Because of that, I feel that the markets will more than likely fall for the next several sessions, but the real fight will begin down below at the large, round, psychologically significant number.

Continued volatility

This market should continue to be choppy though, because there a lot of different things pushing it around. The US dollar could begin to weaken based upon the less than anticipated jobs number on Friday, and if that’s the case that could get a little bit of a boost to the oil markets based upon currency depreciation. At the same time though, the above-mentioned lack of demand could come into play as well. I believe the latter of the two possibilities will control the movement of the market in general, but there will be days where the anticipation of a weaker currency could get so-called “value investors” back into the futures market.

All things being equal, I believe that there is a bit of a roof on this market at the $96 level, so any move above the top of the shooting star will more than likely run into trouble there. That being the case, I would short in that area on the first signs of resistance as well, as I do believe oil is going to struggle for a while.