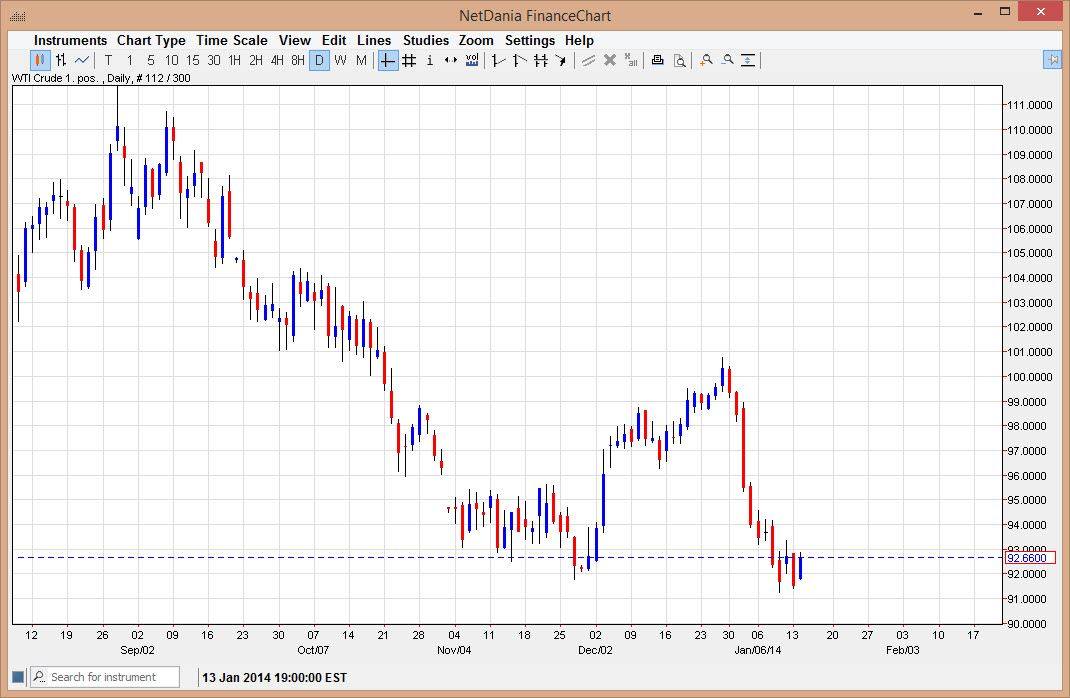

The WTI Crude Oil markets rose during the session on Tuesday, showing that the $91.50 level continues to offer a bit of support. There are a lot of different moving parts in this market right now, but from the technical side we can see that we are certainly trying to consolidate in this general vicinity. This area has been somewhat supportive, but I also see that there has been a bit resistive. However, I think the market is certainly going to be one that is bearish for the foreseeable future, as there are some serious headwinds facing the oil markets

The markets tend to be worried about the potential glut of supply as the Libyans are starting to put more oil into the marketplace, and the Iranians possibly being able to sell into the open market as well based upon the nuclear deals being discussed at the moment.

Look out below.

For myself, I believe that the most important part of this chart is to be found down at the $90.00 handle. That area is obviously a large number that will catch a lot of attention, but on top of that, it appears to be very supportive from a longer-term chart perspective. Because of this, I believe that if we do break down a little bit from here, it will be a short-term move before we see a lot of buyers stepping into the market on a “value proposition.”

A lot of this will also come down to the fact that the market has been so oversold over the last couple of months. Any rally at this point in time though will more than likely just be a bit of a “relief rally”, which of course should be sold on signs of resistance. I could see the $96.00 level bring in a lot of sellers at this point, and as a result would be very interested in selling on a resistant candle in that general vicinity. I believe that we will see the $90.00 handle, but may see higher prices from which to sell between now and then.