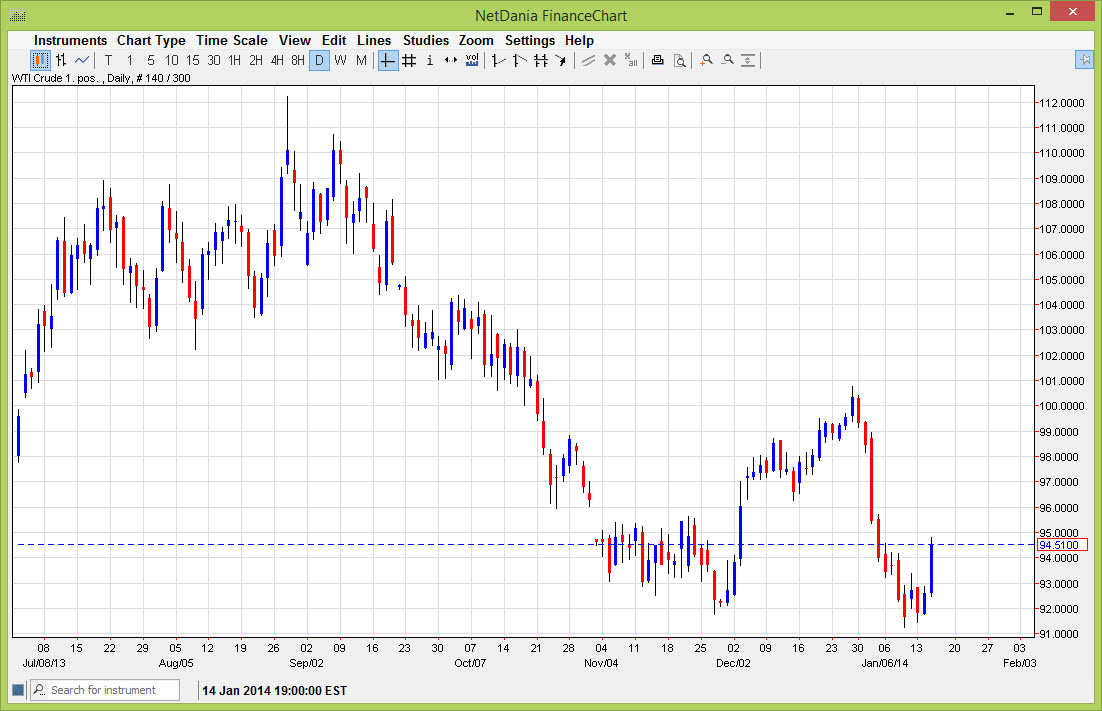

The WTI Crude Oil markets rose significantly during the session on Wednesday, breaking above the $94 level with ease. However, I am still a bit concerned about this marketplace going forward, simply because there is so much noise between here and the $96 level. With that, I believe that a resistive or weak looking candle could be a decent sell signal at this point in time as the $96 level was the top of a significant consolidation area just two months ago.

As so-called “market memory” dictates, there will be sellers at that area, or at least people willing to take profits, which essentially is the same thing. With that, it is not until we get above that area that I feel comfortable going long of this market for any significant amount of time. In fact, at this moment in time I am flat, and on the sidelines simply watching this market.

USD/CAD and its relationship to this market.

With all the noise in this marketplace, you would be wise to keep an eye on the USD/CAD pair, as the Canadian dollar has been under heavy pressure. The selling of the Canadian dollar and the selling of oil tend to run hand-in-hand, and as a result one market can quite often lead the other. With that being the case, the fact that we formed a shooting star on the daily chart also suggests that perhaps the oil markets will continue to go a little bit higher. However, having said that I do believe that there is a significant amount of support below that could be found in that market, just as there is a significant amount of resistance just above in this one. The synchronicity of the two could be a nice trading opportunity in both markets simultaneously.

Going forward, I expect that the oil markets will continue to have a bit of pressure applied to them, especially as the Libyans have started producing oil for export. On top of that, there is the hope that the nuclear talks between Iran and other countries could allow for the Iranians to put oil on the marketplace as well. With that rush of supply, we could have continued weakness.