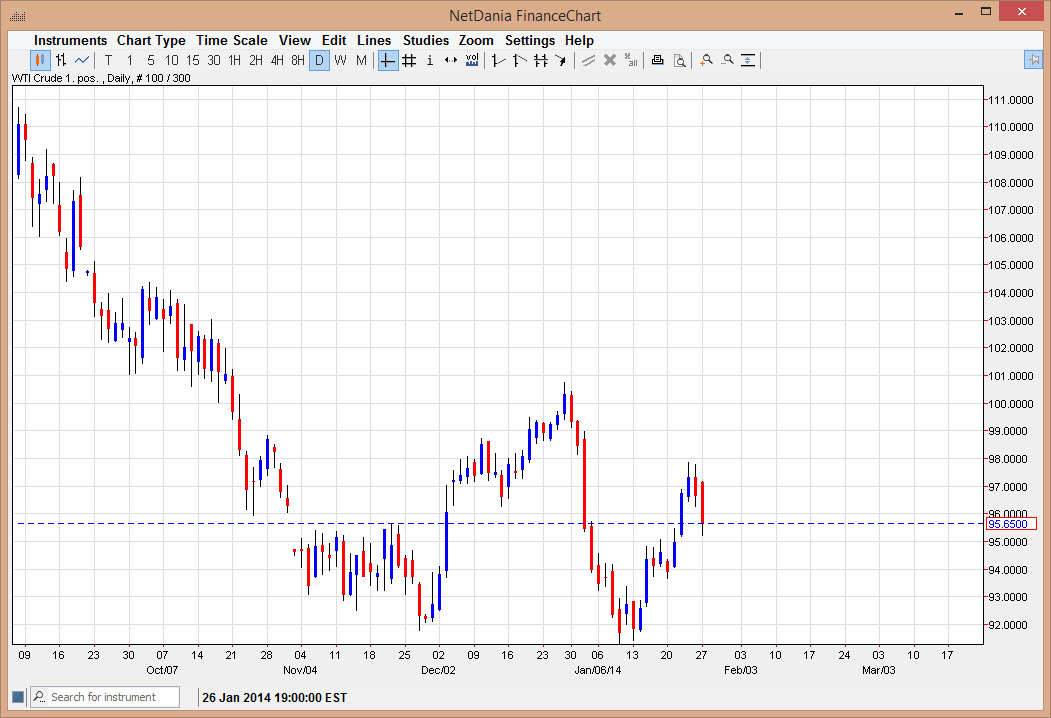

The WTI Crude Oil markets fell during the session on Monday, reversing the recent strength that we have seen in this market. However, I still see a significant amount of support all the way down to the $93 level, which of course the $95 level itself being rather significant. That’s exactly where the market bounce from during the session on Monday, thereby giving be more confidence in the up move that we could be seeing again.

I would like to see some type of supportive candle in this general vicinity in order to start buying this market, and if I got eight, I would not hesitate to start buying as the market certainly has sold off far too much in my opinion over the last couple of months. Nonetheless, we have to be aware the fact that there are a lot of sell orders above, so of course is going to take some strength to get up there.

Federal Reserve meeting and statement on Wednesday.

It is possible that the markets get very quiet over the next couple of days, as we await to see what the Federal Reserve says. With that, we have to keep in mind the whole question of tapering quantitative easing, and with the Federal Reserve might do. The Federal Reserve tightening would of course be strong for the US dollar, and of course drive the price of oil down. However, there is the school thought that if the jobs number improves, that shows an increase in demand for petroleum, which could drive prices up. In other words, it’s a huge mess at the moment.

With all that in the back of my mind, I simply look at the charts as one that has shown me it has broken out above the $95 level, and that the next resistance level is somewhere near the $100 handle. Try not to overthink these situations, because quite frankly you can do nothing because you headaches. I am bullish on this market until we break down below $93, which of course at that point in time I would have to reverse my thought process. Short-term gains will probably be the way to go, as the market should chop around.