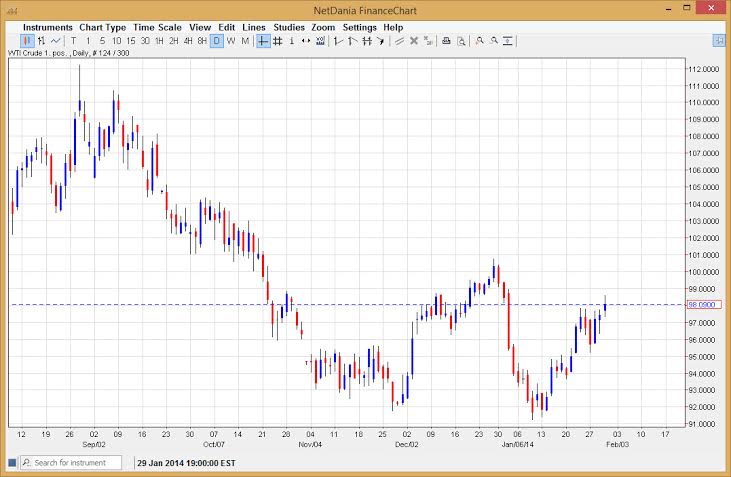

The WTI Crude Oil markets rose during the session on Thursday, breaking above the $98 level. With that, we have finally broken out above the level that I thought would be the biggest problem in the near term. Because of this, I feel that the market is ready to go bit higher, but do recognize that there is a bit of resistance between here and the $100 level. I think that ultimately we will hit that level, but we are almost certainly going to have a lot of trouble getting there immediately.

Any pullback at this point in time should find quite a bit of support just below, and as a result I think that this market will continue to find buyers. Because of this, I believe that you cannot short this market, even though it’s going to be difficult to hang onto any trade for a significant amount of time. Quite frankly, it’s probably better to trade this market in the CFD round, or perhaps options.

Continued volatility in the world’s markets.

I believe that the world’s markets in general will continue to be volatile, and oil of course will be no different. There are several indices in the European Union that are showing signs of finding support now, and I believe that will translate to more risk appetite been seen globally. With that, this market should rise, but I think that the $100 level will be a difficult level to break above right away.

On the move to that level, expect a pullback which should attract more buyers. Ultimately, I believe that we do go much higher but it’s going to take time. Right now, it appears if we can break above the $101 level, we would have in fact cleared a W formation, which of course is very bullish. The $92 level right now does look like it has been a bit of a double bottom, and that of course would be confirmed by breaking above the aforementioned $101 area. As far selling is concerned, I really don’t have a scenario in which I want to do so, simply because I see far too much support below.