The EUR/CAD pair is not one that I talk about often, but it is a decent pair to trade at times. After all, the pair doesn’t have a large spread, and it does feature to very prominent currencies. Both of these are considered to be major currencies, although it should be said that this market is not as liquid as perhaps the EUR/USD, or the USD/CAD pair. Nonetheless, it is a tradable market.

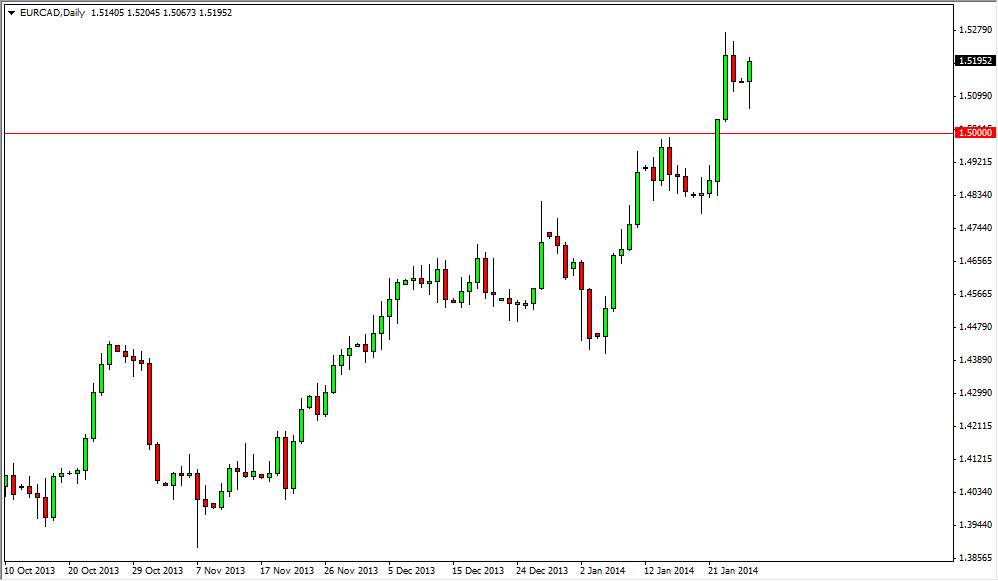

Looking at the way that oil has fallen precipitously lately, it’s not a huge surprise this pair continues to go higher. What has caught my attention now is the fact that the daily candle from the Monday session did in fact try to reach the 1.50 level, and as a result found buyers and got pushed back up enough to form a hammer. The hammer is one of my favorite buy signals, and since it’s with the trend, I think it’s a very valid signal indeed.

1.52 looks to be the signal.

Where this hammer sits suggests to me that we are in fact going to go higher, but need to see a break above the 1.52 level in order to follow through. I see absolutely no reason to think that it won’t happen, and as a result believe that this market is one that you can only buy.

Even if we were to fall from here, my suspicion is that the 1.50 level will offer enough support to keep it as simple consolidation, or perhaps a rest in an otherwise very bullish market. That’s something that the market be from time to time, and as strong as the uptrend is been that would exactly be a huge surprise. The Euro is still strong overall, and because of that I believe that this pair should go higher overall anyway. On top of that, the Canadian dollar has been absolutely pummeled as well, so this pair is being pushed higher from at least two different directions. I believe buying dips will be the way to go going forward, and that the 1.55 level will be targeted eventually.