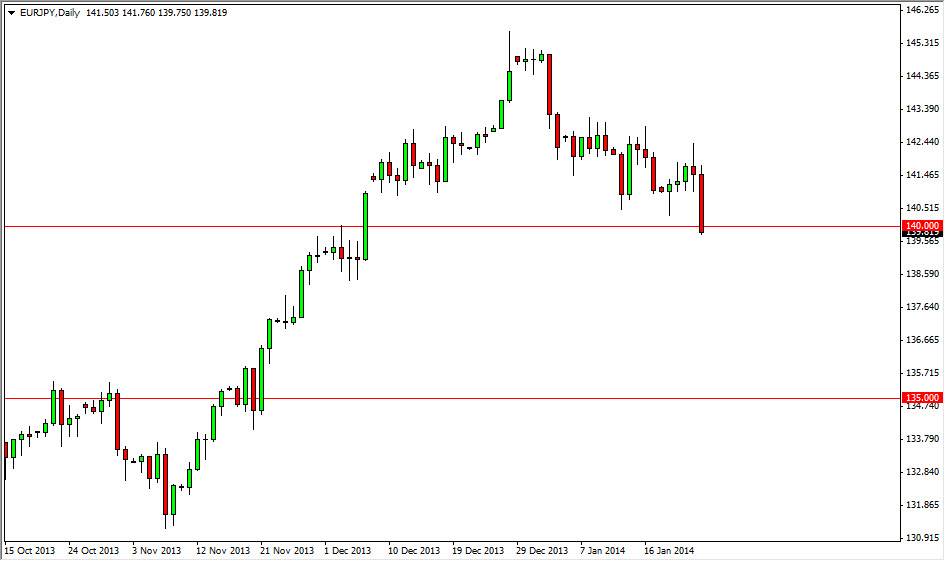

The EUR/JPY pair fell hard on Friday, slamming into the 140 level. The market has a lot of support below, extending all the way down to the 138.50 level, as we have seen quite a bit of noise in the general vicinity. However, the candle does look rather resistive and weak, and as a result I believe that this market will attempt to break down below that area. If we can break down below the 138.50 level, I feel that this market will more than likely make an attempt all the way down to the 135 handle. This is a necessarily anything to do with the Euro, but I think it has more to do with the fact that the Yen has accelerated its gains recently.

This market of course follows the risk appetite of traders around the world, and as a result I believe that this market will be heavily weighted upon what the FMOC does on Wednesday. Because of this, it’s possible that we don’t break down until after that, so the sideways action could come back into play.

There is the possibility of a bounce.

There’s also the possibility of a significant bounce from here, as it is a very large round number and of course has a lot of psychological significance. Granted, the candle on Friday was very negative, but since it sits right on top of support, it’s hard to get overly excited about selling at this point.

If we do get a bounce from here, the market will more than likely fight to reach the 143 level. Above there, I believe that the 145 level will offer resistance as well. It has recently, and with that I believe that breaking above that will send this market looking for the 150 level. I believe ultimately that’s what we do, but in the meantime we could have a little bit of negative action. In the end though, this market is simply reflecting the overall pullback of risk appetite worldwide. With that, I believe that it only will take a matter of time before we go higher.