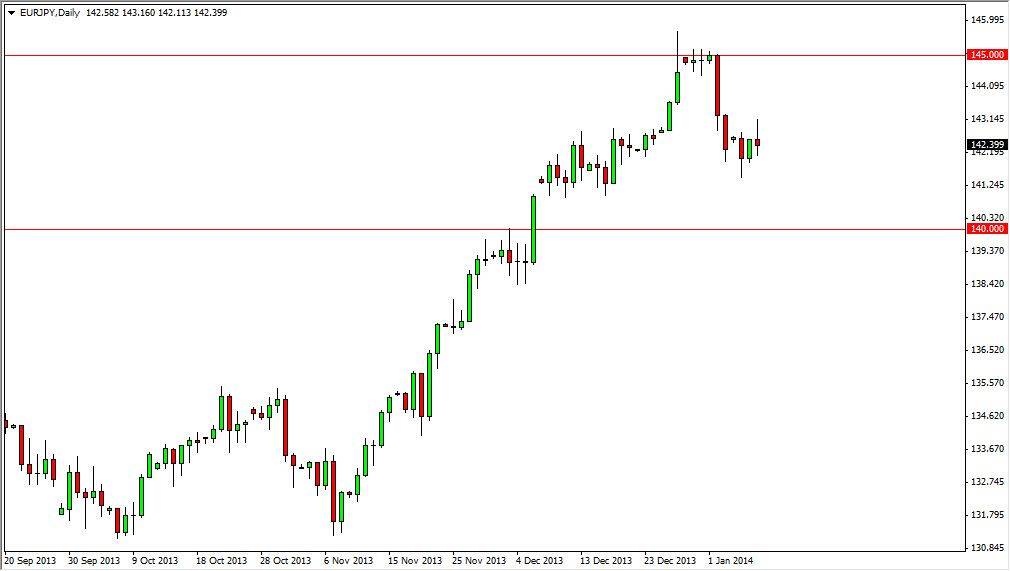

The EUR/JPY pair try to rally during the session on Wednesday, but as you can see ran into far too much trouble above the 143 level. The resulting action formed a shooting star, and although I look at that is one of the most bearish candle shapes out there, you also have to pay attention to the fact that we formed a hammer just two sessions previously. Because of this, I feel this market is probably going to consolidate in the short-term more than anything else. The back and forth pressure in the marketplace should continue to keep the market hovering around the 142.50 level, at least between now and the all-important jobs report coming in a few sessions.

It’s not that the jobs report is something that you would look to Europe or Japan for a reaction and, it’s more or less a “risk on, risk off” proposition as this pair does tend to follow global risk appetite in general. The more comfortable the markets are with taking risk, the better this pair tends to do.

145 still matters

The 145 level still matters, and I believe that any move higher is going to struggle with that area. However, I also believe that it will eventually be taken out to the upside, so buying is the only thing that I can do in this market. A break above the shooting star from the session on Wednesday is reason enough to start going long, but I recognize that the 145 level will be a significant barrier.

Any type of pullback that we see in this market over the next several weeks should be a buying opportunity, and I believe that the market will struggle to get below the 141 handle. In fact, I think there is support from 141 all the way down to the 140 handle. It is not until we close well below 140 that I would even consider selling this pair, and quite frankly I just don’t see that happening anytime soon. Ultimately, I expect to see this pair hit the 150 level.