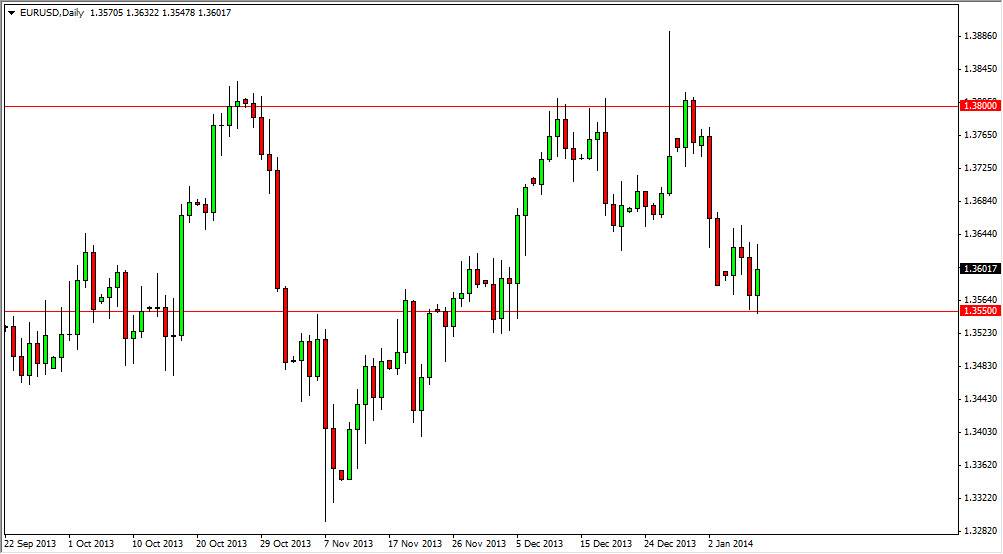

The EUR/USD pair bounced off of the 1.3550 level during the session on Thursday, showing that the area is in fact going to be supported going forward. Because of that, I believe that this market is ready to go higher in the short-term, but we will have to keep an eye on the 1.3500 handle as it is significant support as well. If we can get below there that should signify that the Euro really starts to fall apart. Remember, even though the world is focusing on the Federal Reserve right now, the fact is that there is a significant amount of concern about deflation in the European Union right now. That generally works against the value of the local currency, as the central bank will typically loosen its monetary policy.

All that being said, it appears that the 1.3650 level is a bit of resistance as well, so in the short-term expect a lot of choppiness. However, at the end of the day we have a much more important thing to pay attention to right now, the nonfarm payroll report numbers coming out today.

Nonfarm payroll numbers

The Federal Reserve is going to be under the microscope during the session today, as they have already stated that the employment situation in the United States is the one thing that keeps them concerned about further tapering. Nonetheless, if the jobs number is strong enough, that could in fact be reason enough for the Federal Reserve to be able to taper off of quantitative easing and therefore should strengthen the US dollar. I believe at that point in time we will begin to focus more upon the potential issues in Europe, and less upon whether or not the Federal Reserve is going to suddenly become a hawkish. That’s the way this pair tends to operate: Focus on one side of the Atlantic or the other, and very rarely both.

With that being said, I’m going to wait until I get a daily close though, as nonfarm payroll Friday’s tend to be notoriously schizophrenic at best.