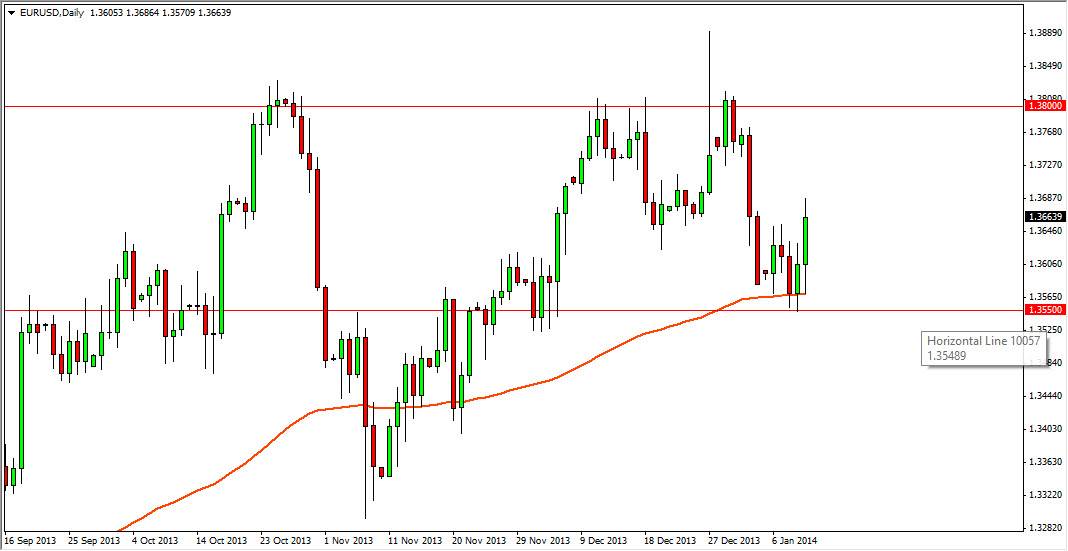

The EUR/USD pair initially fell during the session on Friday, but as you can see bounced off the 100 day EMA as it provided dynamic support. This market continue to go higher from this point in time, mainly predicated upon the nonfarm payroll numbers coming out weaker than anticipated in the United States. Because of this, the US dollar sold off against pretty much every other currency out there, and of course the Euro was the main beneficiary as it is the “anti-dollar.”

Now that we’ve seen this move, it’s very likely that we will continue to the top of the reason consolidation area, which I have marked on this chart as the 1.38 handle. I don’t know if we can get above that level, but it’s very likely that the sellers will step back into the market at that area regardless, so at the very least I would anticipate some type of struggle in that vicinity.

This pair comes down to who we are focusing on.

One of the things that has made this pair very difficult to trade over the last several years, and Lisa’s the financial crisis head, is the fact that the market tends to ignore one side of the Atlantic, and then focus on the other. At this moment time, it appears that the sole focus is on whether or not the Federal Reserve will taper off of quantitative easing. That being the case, it seems that we are completely ignoring the fact that deflation could be rearing its ugly head in the European Union, which of course will eventually cause problems for the Euro itself. This is why I think this pair will continue to chop around every couple of weeks or so, and become a short-term traders market.

Adding to that the fact that the algorithmic traders are starting to become more and more prevalent in the Forex markets, I believe that this could become the norm for this pair in the meantime. We need to see some type of clear hot economic turn in one direction or the other in order to get some type of stability. Nonetheless, I see a buying opportunity of the next several sessions.