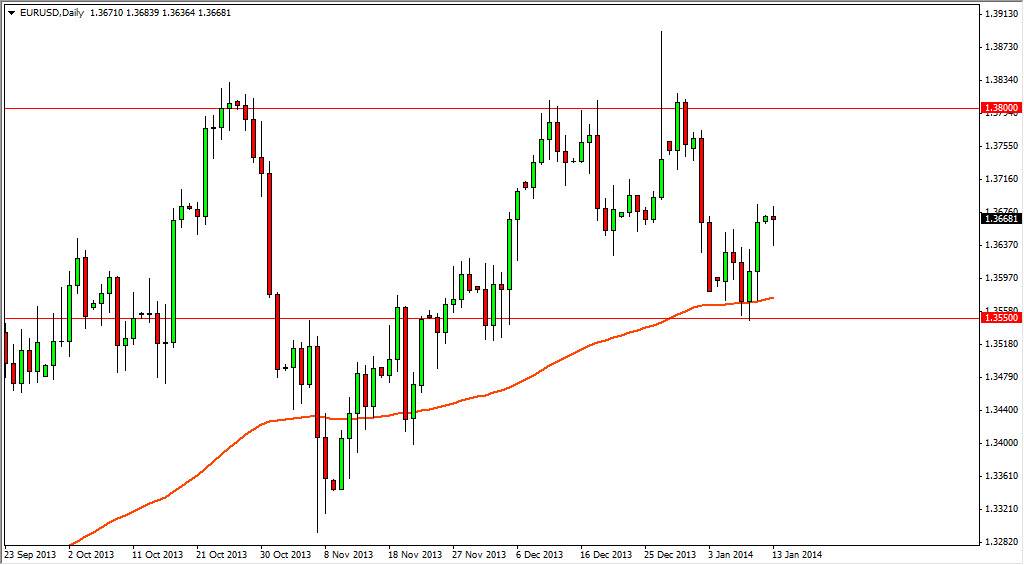

The EUR/USD pair initially fell during the session on Monday, but as you can see bounced enough to form a nice hammer. This hammer suggests that the market is still somewhat bullish, especially considering that the Friday candle launched from the 100 day EMA, a very common moving average for traders to use. While I am not a huge proponent of moving averages, I do recognize that some of them are actually somewhat followed.

The shape of the hammer suggests that the buyers may step into this market every time it falls. This is probably going to be true at least in the short-term, and will be exacerbated by the fact that the jobs numbers out of the United States were so weak. After all, the Americans only added 74,000 jobs during the month of December, which of course is much lower than the anticipated 187,000 or so. That of course was a massive mess, and of course the Euro was the one to benefit as it is considered to be the “anti-dollar.”

Jobs, jobs, jobs.

The jobs numbers of course will continue to influence the way the US dollar trades, and therefore influence the way the Euro trades. Because of this, I believe that for the next couple of weeks we should see Euro strength, mainly because there won’t be any way to “negate” the nonfarm payroll number between now and the beginning of February. With that, traders will find a way to push the Euro higher in my opinion.

Having said that, I believe that the 1.38 level will be resistive, and even if we get above that area we will more than likely find quite a bit of trouble all the way to the 1.40 handle. If we get above 1.38, I do think we will find 1.40, but it won’t necessarily be an easy ride all the way up there. Short-term traders will more than likely continue to bite dips every time they appear in this market, and therefore I am not interest in selling it anytime soon as it will simply be easier to go with the flow.