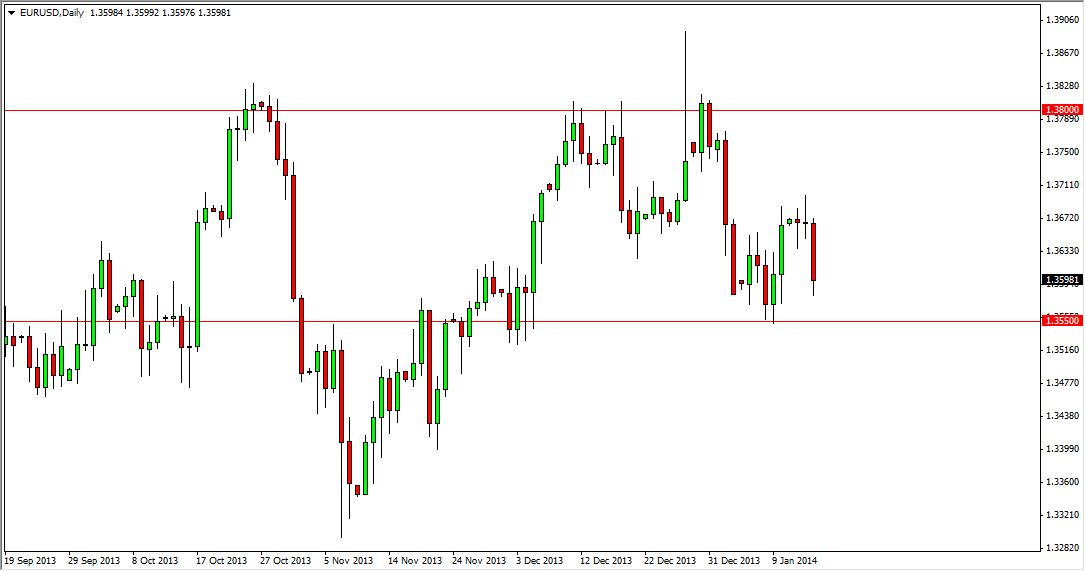

The EUR/USD pair fell during the bulk of the session on Wednesday, testing the 1.36 level. However, this area is the beginning of significant support going all the way down to the 1.3550 level, and as a result it’s possible that the buyers will more than likely push this pair back up. After all, I see this market is one that’s been stock in roughly a 250 range. Because of this, I believe that the 1.3550 level will continue to hold as support, and the 1.38 level above will continue to hold as resistance, making the market essentially banging around in this general vicinity for the foreseeable future.

Short-term traders will probably be attracted to this market going forward, simply because there is nothing the move in one direction or the other for any real length of time. With that, I personally don’t like trading this pair for short-term moves, simply because of the choppiness. However, I do recognize that the next move is probably higher, simply because the Euro seems to have nine lives.

Jobs numbers out of America need to improve.

Right now, everybody is worried about whether or not the Federal Reserve can taper further. With the jobs numbers been so poor last week, there’s absolutely no sign that the Fed can do anything of significance in the near term. With that, it’s very unlikely that the market will be able to break below the aforementioned 1.3550 handle, and as a result is going to be difficult to hang onto any short trade for any real length of time. Since the Euro seems to be one of the currencies out there that traders flock to given any opportunity, I am more apt to go long of this market overall anyway. They may all be short-term trades, but I do believe eventually we will retest the 1.38 handle for resistance.

Above there I see a ton of resistance all the way to the 1.40 level, so if the market is choppy now, I can only imagine the choppiness that we will see above that level. Expect short-term trades at best, and extreme choppiness.