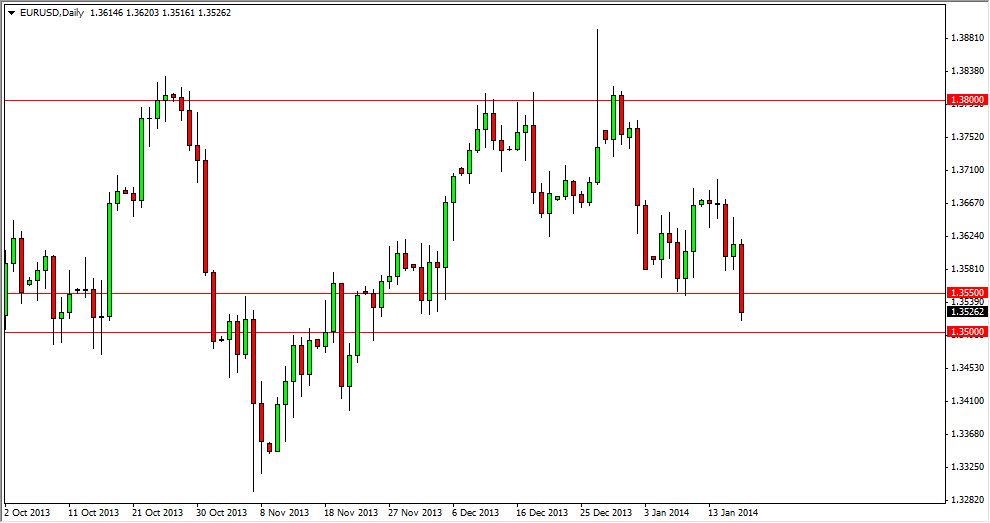

The EUR/USD pair fell during the session on Friday, breaking down below the 1.3550 level. This is an area that I have been talking about for some time now as I believe it is very supportive. That area being broken down suggests that we are starting to see more weakness in this market, but I recognize that the market should have support all the way down to the major handle, which of course is the 1.35 level. Because of this, I am not ready to start selling this market now, but do recognize that a close below the 1.35 level is a significant turn of events.

With that being said, there is the possibility that we get some type of supportive candle. If we get that supportive candle in this general vicinity, it could in fact be a nice buying opportunity as the market could end up going back and forth in the previous consolidation area all the way up to the 1.38 handle.

Jobs numbers will continue to push this market overall.

I believe that this market is essentially suggesting that the Federal Reserve will not be able to taper with any significant amount of strength. Because of this, we have to watch the job numbers in order to find out whether or not there is a reasonable chance for the Federal Reserve to get aggressive and its monetary policy, which of course would drive this pair back down. One thing to think about is the fact that the European Union is facing deflationary problems, and that of course can drive down the value of the Euro as well. With that being the case, we may have a little bit of a “perfect storm” if the Americans do in fact present better employment numbers than they did for the month of December.

All things being equal though, even if we do break down from here I believe that the 1.33 level will be supportive as well. There is no such thing is a straight move up or down in this pair, at least not in the last few years. I see nothing on this chart does suggest that any move will be easy.