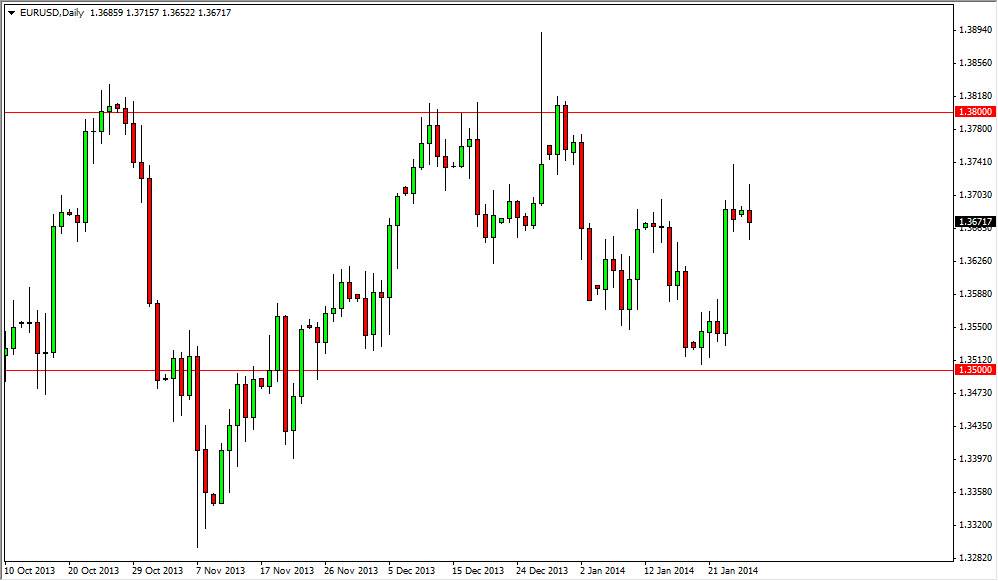

The EUR/USD pair went back and forth on Monday, essentially mirroring the action that we saw during Friday. It isn’t quite a shooting star, but it is much more of a shooting star that it is a neutral candle, so I believe that the Monday session essentially says the same thing: That the area above the 1.37 level is going to be resistive in the short-term. When you look at this market, it makes sense that perhaps we could see a little bit of a pullback in this general vicinity as we bounce around between 1.35 on the bottom, and 1.37 on the top.

That would not exactly be a real stretch of the imagination as his pair likes to grind around quite a bit, and quite frankly since the financial crisis has been a bit of a pain to trade at times. However, the two sessions that we have just closed suggests to me that weakness is probably more likely than strength.

FMOC meeting.

With the FMOC meeting going on this week, this pair of course will be very sensitive to what goes on. Any hint that the United States might tighten its monetary policy of course will send this pair going lower, as it which significantly strengthen the US dollar in general. However, I don’t think that we will see anything major, at least not earth shattering at this point. With that, I believe that any pullback at this point time will more than likely find buyers, and I would be really hard-pressed to see this market go below the 1.35 handle.

Far as to the upside, I think get above the 1.38 handle we would have white a fight all the way to the 1.40 level, as it has been so resistive up in that general vicinity. With that, I think that we continue to chop around and stick to the short-term charts in the meantime. Expect a lot of noise on Wednesday afternoon during the North American trading, but quite frankly at the end of the day we need clarity - something we may not get it all.