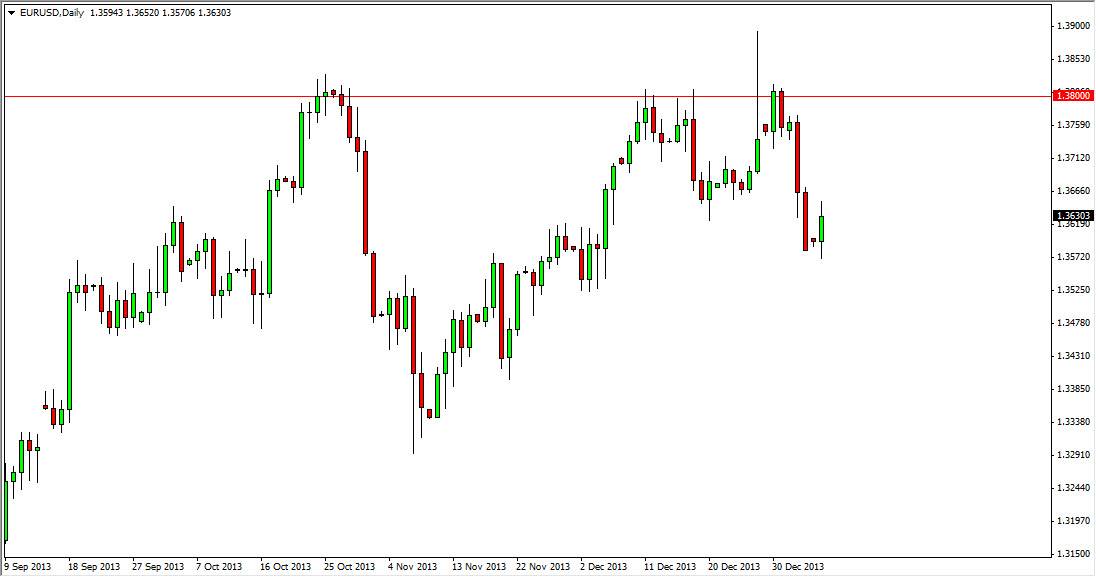

EUR/USD had a slightly positive session on Monday, testing the 1.3650 level but pulling back slightly at the end of the day. I being the case, it appears that the 1.36 level has offered enough support to keep the market somewhat afloat though, and as the nonfarm payroll numbers coming fairly soon, I believe that this market could grind its way a little bit higher as we await those important economic numbers.

This area should be supportive if you look bank and the end of November, as we had seen so much chopping in the general vicinity. This market continues to be one that will be greatly influenced by the Federal Reserve, and that of course means that we worry about jobs in America. After all, it appears that the Federal Reserve can go ahead and taper even more, that should send this pair drastically lower as the world worries about deflation in Europe. I should state though, we aren’t necessarily worried about it at the moment - just that it is something that people are starting to be concerned about.

Sideways and choppy trading.

I believe that this market will continue to chop sideways between now and the nonfarm payroll number, simply because the economic number will be far too important. Granted, it’s hard to read too much into this chart over the last week as we had almost no liquidity, and there was the headline that Credit Suisse had suddenly switched its opinion on the Euro, becoming very bearish. The reaction to that announcement was probably aggravated by the lack of liquidity more than anything else, and as a result I don’t think that the significant pullback meant much, and as a result I think the real action that can be read from a technical analysis plan view will be after the nonfarm payroll numbers, as it will show how the market truly “feels” about the Euro versus the Dollar and the economic situations on both sides of the Atlantic. That being the case, short-term trades at best it will be will probably see over the next several sessions.