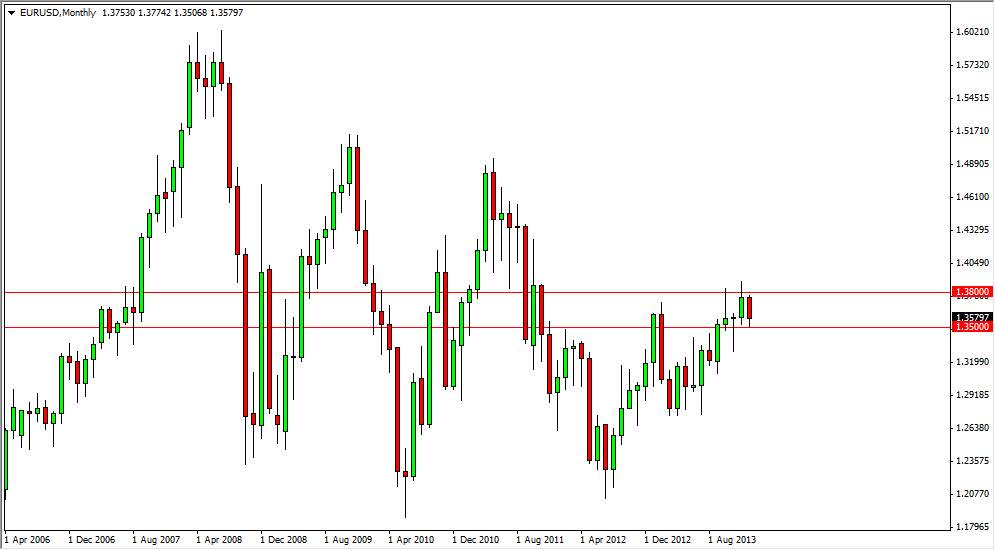

The EUR/USD pair fell during the month of January, but you can see still remains locked in a fairly tight range. Essentially, with the exception of a little bit of a breakdown during the illiquid month of December, this market has been stuck between 1.35 and 1.38 for the last four months. This is a natural, as markets tend to try to find some type of inertia, but as you can see this pair has been basically chopping back and forth since 2007.

Unlike the GBP/USD pair that I have also done analysis for, this pair hasn’t had a tight consolidation area. It’s been very sloppy and erratic. In fact, I have a lot of friends who have simply step away from this pair for the time being. After all, who was to trade a market that just slams around like this? It’s not like there are well-defined boundaries they can be easily picked up. While it’s not as sexy or adventurous trading a pair that is very predictable, it is much more profitable. Without a doubt, the GBP/USD has been a much easier trade over the last several years.

Two levels to watch.

Having said all that, I believe that there are two levels to watch. The 1.38 level getting broken to the upside would be relatively significant, and even more important if we break above the 1.40 level. I believe a move above the 1.40 level will send this market much higher, but we are going to have to have some kind of resolution to the questions out of the market for the Federal Reserve in order to get that move. After all, people are you beginning to wonder how much tapering the Federal Reserve can do, and eventually that will strengthen the US dollar. During the month of January they cut off another 10 billion in the bond buyback program, but the market was pretty much expecting that. The real question is whether or not the ECB is going to have to deal with deflation? If Europe can escape that, this pair should go higher.

The second level to watch of course is the aforementioned 1.35 level. If we can break down below that it’s, I suggest that we go down to the 1.33 level, and then possibly 1.27 level. However, the downside certainly has a lot more noise to it than the upside, so I still think this pair is somewhat biased to the upside. Expect more choppy and obnoxious trading patterns for the month of February out of this market.