Forecasts as far ahead as several weeks should always be taken with a pinch of salt as the underlying circumstances of the market may change fundamentally over such a long period of time. However, it is possible to have some predictability if there are no dramatic market events over the month.

This pair seems caught in a long-term consolidation and enjoys only limited price movement, the current signs are that this is likely to continue during February, but a lot will depend upon how this current week closes. If this week does not close below 1.3583 (January's opening price), then February is likely to be a ranging month best trading by shorting obvious resistance levels towards 1.3800 and longing obvious support levels around 1.3600 or below.

Technical Analysis

The technical picture is conflicted and stagnant, meaning this pair is giving little opportunity. We are established in both a long-term bullish channel and a shorter-term bearish channel, as can be seen in the daily chart below:

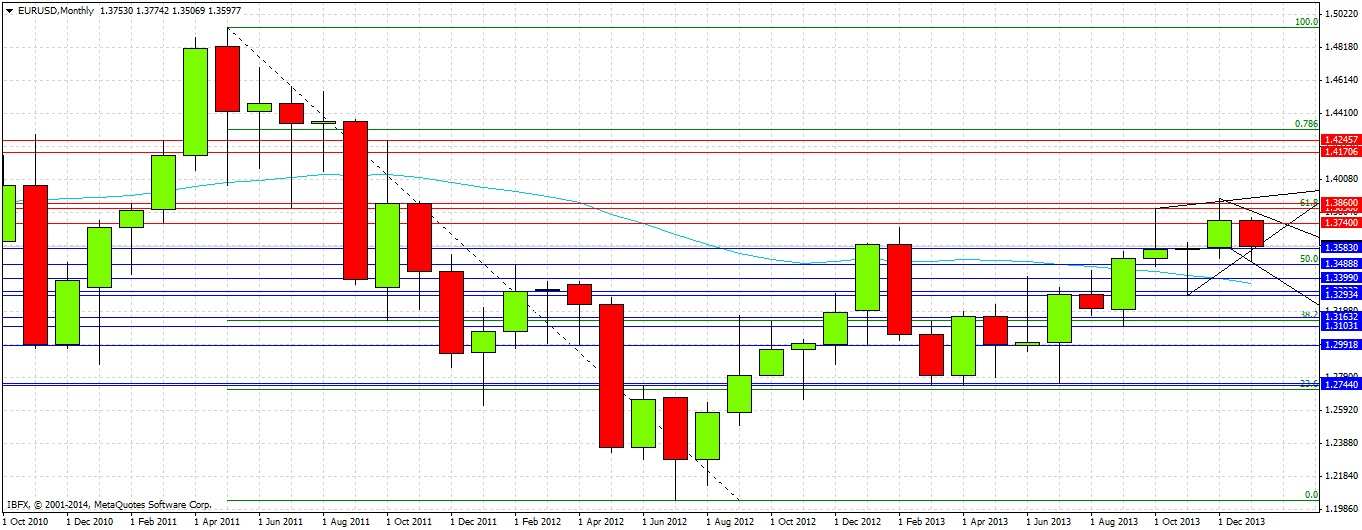

The monthly chart shows that we have been in a weak uptrend since the summer of 2012. There has not been a strongly bearish monthly candlestick for almost one year. That will change if this week closes below 1.3583, as this would print a monthly bearish engulfing candle, as shown in the monthly chart below:

The weekly chart (not shown) shows a mixed and unclear picture.

If this month closes below 1.3583, and we then break this month's low during February, that is a sign to then be more confident taking short rather than long trades.