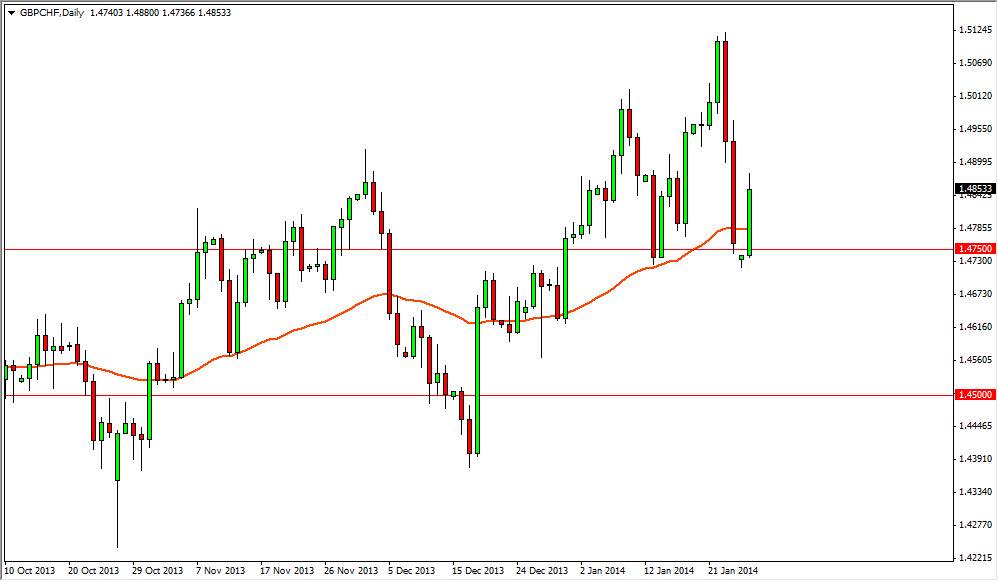

The GBP/CHF pair had a positive session on Monday, bouncing off the 1.4750 level, an area that has been supportive recently. Because of this, it appears that the level continues to be the so-called “floor” in the market right now, and with that I think that short-term buyers will continue to support the market right around this area. On top of that, you can see that the 50 day exponential moving average and is one that the market seems to be paying attention to at the moment, and therefore it is acting as dynamic support. Now we are back on top of it, and quite frankly didn’t fall far enough below it to be overly concerned as far as the buyers are concerned.

I like his pair a lot, simply because it’s got a reasonable spread, it’s nice and volatile, and it tends to follow risk appetite in general. However, you can see that the market certainly can be erratic at times, as witnessed on Thursday and Friday of last week, as the market sold off rather sharply. However, when you look at this chart you see the opportunity to bounce just as quickly.

Pay attention to the world stock indices.

As a general rule, you can trade this market right along with the DAX, Nikkei, S&P 500, FTSE, MIB, and the general attitude of many of the other large markets. On any given day, they tend to move in the same general direction. With that, if the markets are going well on the whole, this pair typically does as well. Of course there are days where something is going on specifically in the Swiss franc or the British pound, but as a general rule this correlation does hold.

We started to see a little bit of support towards the end of the day on Monday as far as European indices were concerned, as a result this might be a harbinger of a move higher in risk appetite over the next couple of sessions. With that, I believe that a break above the highs from the session on Monday is in fact a nice buy signal.