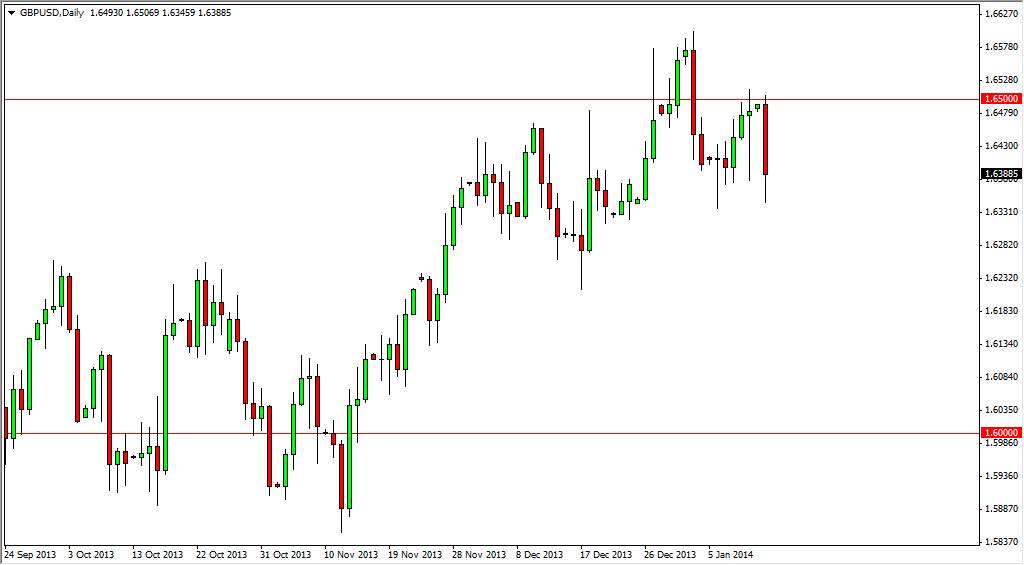

The GBP/USD pair fell hard during the session on Monday, as the 1.65 level offered quite a bit of resistance yet again. Because of this, it appears that the market found some type of support down near the 1.6350 level again, and therefore we could possibly be testing the range of the previous consolidation area that we have been in. That being the case, I feel that this market is probably going to be more or less a short-term traders market for the next couple of sessions. Even if we broke down from here, I still feel that the 1.6250 level offer support as well. After all, the trend is decidedly been up over the last couple of months.

The shape of the candle of course is very negative as well, as we closed towards the bottom of it. However, the 1.6350 level did in fact cause a little bit of a bounce, so on the shorter-term charts it looks like we could possibly see buyers stepping into the marketplace. The question then becomes whether or not it was simply end of the day profit-taking, or was it actual buying pressure?

British pound strength through and through.

The British pound has been strong for and through, against most currencies in the Forex markets lately. I believe this will continue, but the US dollar is going to be a little bit different in the sense that it is considered to be a “safe haven currency.” Nonetheless, I am still positive of this pair, but I need to see some type of supportive candle on a little bit longer time frame in order to get too excited about buying. I would want to see on at least the four hour chart, and quite frankly the daily charts even better and gives me much more confidence. With that, I am a buyer, but not here, not now. I believe that the market will give us a buying opportunity over the course of the next several sessions, but until then will remain on the sidelines.