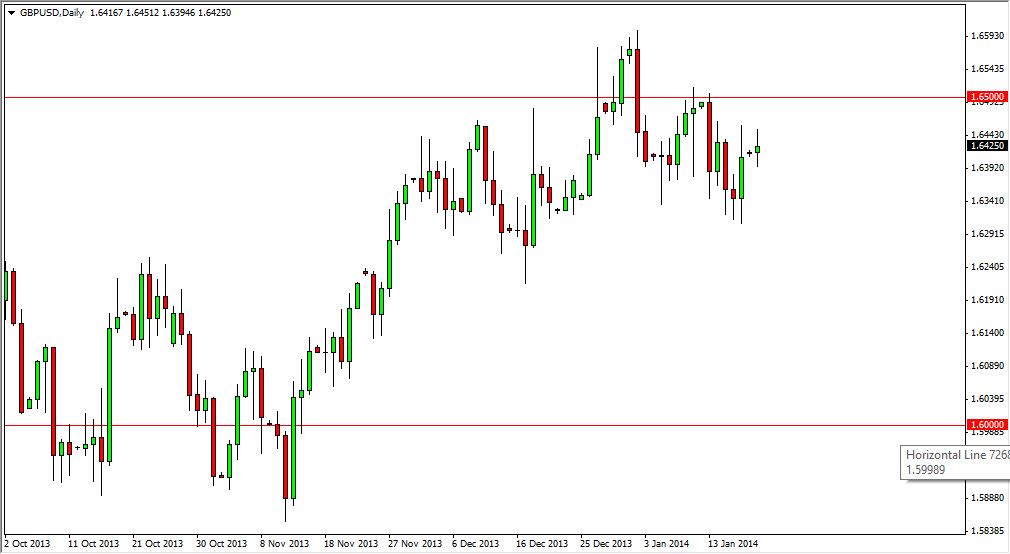

The GBP/USD pair did very little during the session on Monday, basically grinding back and forth to finish the day relatively unchanged. However, when you look at the totality of the marketplace you can certainly see that there is an underlying bid to this market. On top of that, the British pound itself has done fairly well for some time now, so shorting it isn’t necessarily something I would be interested in any way. However, if there’s one currency out there that could be upon the Pound a little bit, it would be the US dollar.

I see the 1.65 level as significant resistance above, extending all the way to the 1.66 handle. With that, I believe that if we get above the 1.65 level, it’s only a matter of time before we go higher and break above the 1.66 level. Above there, we have the 1.70 level as the next target, which is my thesis overall.

Pullbacks should be thought of as momentum building exercises

I believe that any pullback that we see in this market will more than likely be an attempt to build momentum to break out above the 1.65 handle. In fact, if this market pulls back and find support somewhere near the 1.63 level, I believe that would be a perfect place to take advantage of perceived of value. The British pound continues to be one of the favored currencies out there, and even though this is been more or less a sideways affair for two months now, overall the British pound has done well, and as a result I believe this pair has more upside potential than down.

For me, I believe that the “floor” in this market is actually the 1.60 area. We could go as low as that area and still find buyers I believe. The marketplace has been choppy for some time though, so expect short-term trades to still be the bulk of what moves this market. That being said, if you have the ability to play the options market, this might be a nice way to straddle a consolidation area.