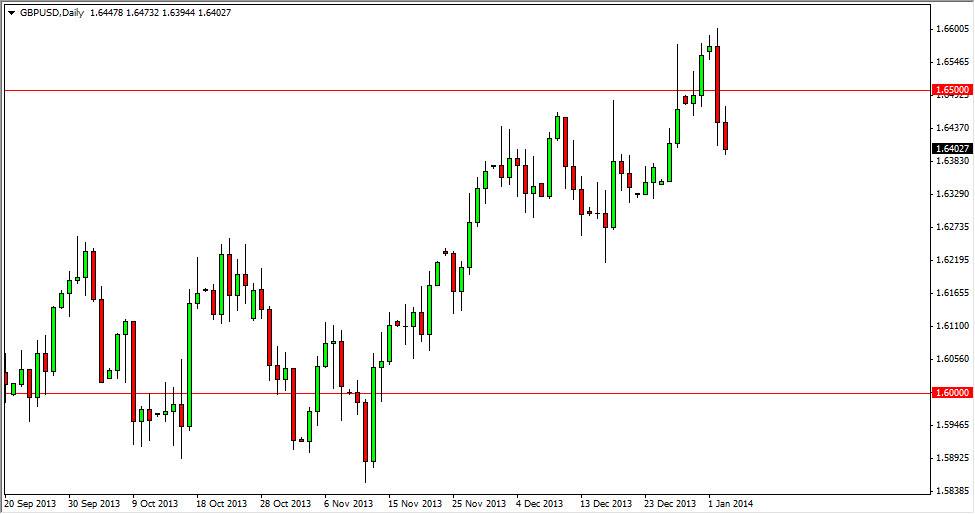

The GBP USD pair fell again on Friday, slamming into the 1.64 support level. It is here that we should start to see significant support build up in the marketplace, based upon the clustering that we saw in this market back during the month of November. That being the case, I am actually looking for some type of buying opportunity, although the weekly chart does show a shooting star.

I understand that the US dollar is favored at the moment, and in most circumstances I would even consider selling it. However, the British pound has been so strong lately that one has to expect that overall it will do better against the US dollar than many of the other currencies that are typically trade. I don’t expect some type of blast higher, I believe that this market will continue to grind higher over time though, as the momentum of the British pound itself should just continue to push the market higher.

Supportive candles

I believe that any supportive candle below here is a potential buying opportunity, and that is especially true near the 1.6250 level. That area had served as significant support back during the month of December, especially when we solve the hammer form a couple of weeks ago. Because of this, I believe that it offers a significant amount of support going forward, and that the market should continue to grind higher over the next several weeks, if not months. However, in the meantime we do not have the supportive candle in order to start buying, so I believe that taking a break from going long of this pair is probably the prudent thing to do with the moment.

There is the possible effect from the nonfarm payroll number on Friday, but at the end of the day I believe that this market should continue to grind higher no matter what the number is, simply because there has been so much momentum forced into the upside. Ultimately, I think the 1.70 level will be tested, given enough time.