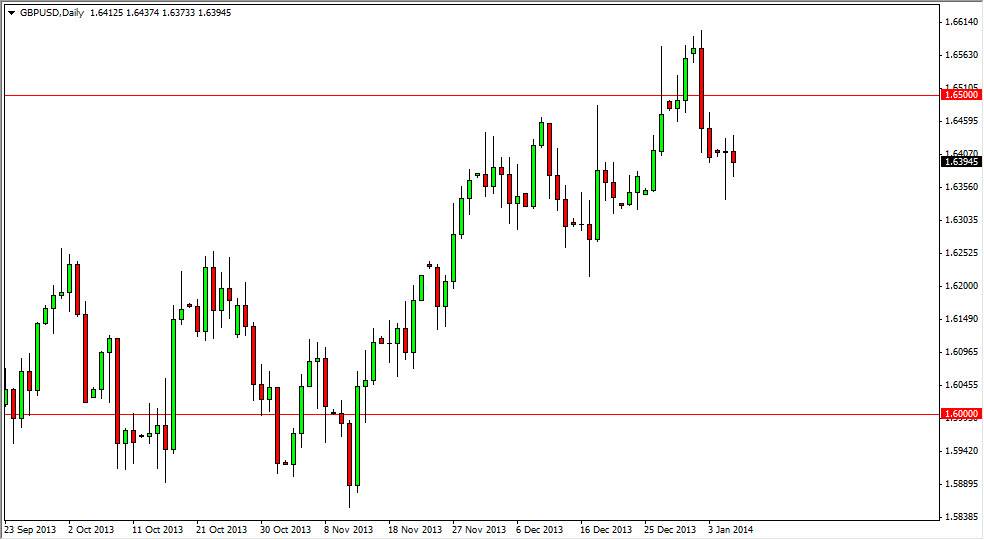

The GBP/USD pair fell slightly during the session on Tuesday, but as you can see found enough support below in order to signify that the 1.64 level is indeed going to continue to offer buyers in this market. That being the case, I feel that the market should continue to March towards the 1.65 handle, but at the end of the day could be a bit choppy over the next several sessions as the nonfarm payroll numbers will more than likely dictate what happens with the US dollar overall. I believe that the British pound will continue to be favored, but it could struggle a little bit against the US dollar simply because of expectations of tapering in the future. That’s not to say that the pair should fall, rather that the British pound may gain more traction against other currencies.

Be that as it may, I still believe that this market will eventually target the 1.70 handle. It probably has quite a bumpy ride between here and there, so I think that it will more than likely take a significant amount of time. With that, I believe that the market will be one that offers plenty of buying opportunities, when we pull back and see supportive looking candles on a shorter time frames.

Monday’s hammer could have been a swing low.

By its very definition, a hammer could have been a swing low. We haven’t gone anywhere yet, but this is typical trending behavior that we are seeing right now in this market. I believe that you will continue to see a little bit of a channel going higher, at roughly a 45° angle. Regardless, the next couple of days will probably give you plenty of buying opportunities based upon the fact that the markets probably won’t do much between now and the nonfarm payroll numbers. If this pair sells off significantly, I’d be more than willing to buy that move as it would be overdone and be a bit of an overreaction, unless of course the United States print some type of outrageous jobs number. More than likely, it will be a temporary reaction, and will represent value to most long-term players.