Forecasts as far ahead as several weeks should always be taken with a pinch of salt as the underlying circumstances of the market may change fundamentally over such a long period of time. However, it is possible to have some predictability if there are no dramatic market events over the month.

This pair is established in a long-term uptrend which is beginning to show some signs of weakening. Despite this, it seems likely to continue upwards during February, especially if January closes above 1.6450. However there is strong range resistance at at 1.6750 and the price may well not be able to break past that level during the coming month.

Technical Analysis

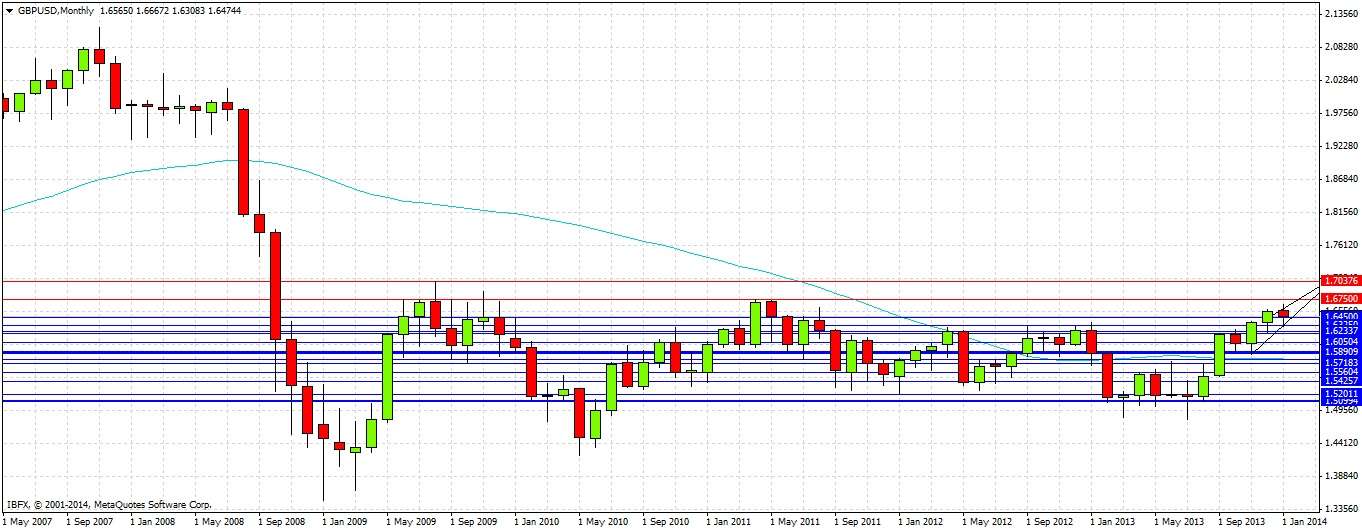

The very long-term picture shows this pair has been ranging between roughly 1.6750 and 1.5000 over the past few years. Since last summer, the pair has been in a moderately strong uptrend that began at near the bottom of this range, with not a single monthly bearish engulfing candle having printed. We are now not far away from the key psychological level and range top of 1.6750. This suggests that we may not have the momentum to break up through this level yet. This month's candle is currently weakly bearish and will remain that way if the support level of 1.6450 holds. This would suggest a moderately bullish bias, at least up to 1.6750. All the above can be seen on the monthly chart below:

The weekly chart (not shown) shows that since last summer we have not had a single bearish engulfing candle. This is a sign that the uptrend is strong, but weakening, shown by the recent long upper candle wicks and the fact that week before last came very close to engulfing bearishly.

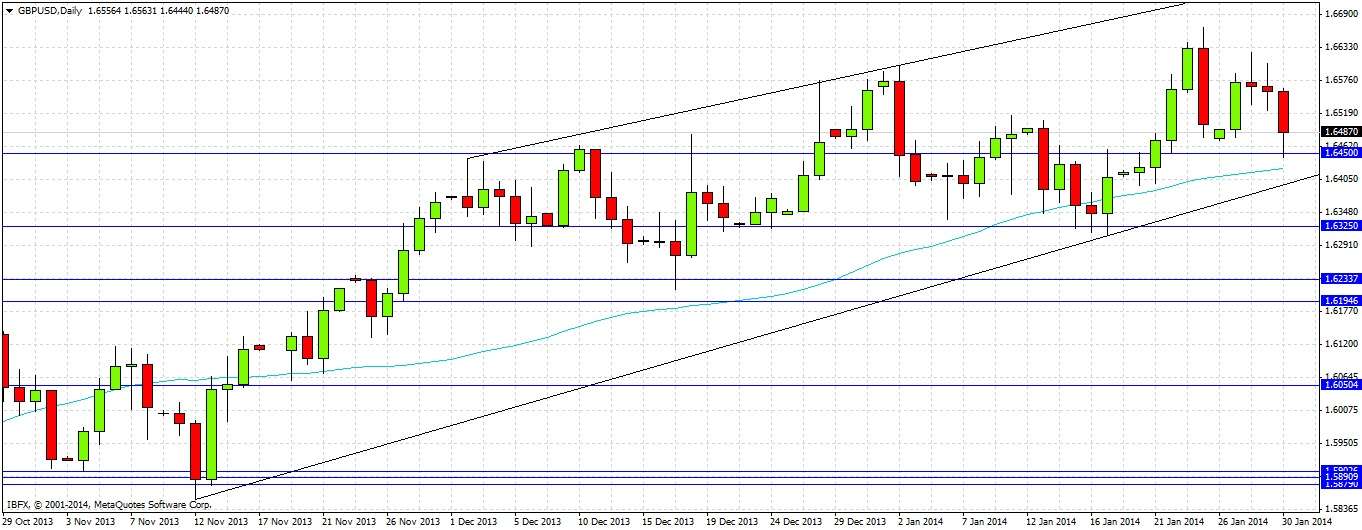

The daily chart shows a different story and suggests bearishness. The most recent valid engulfing candle was bearish. If this week closes below the support at 1.6450, it suggests we will have some kind of move downwards. If this level holds, we are more likely to continue upwards. So far, it looks like this level will hold. Additionally, we are still well established within a long-term bullish channel:

If this month closes above 1.6450, that is a sign that we are likely to continue upwards to 1.6750 during February, although that may be the end of the uptrend, at least for a while. A monthly close below 1.6450 would suggest we revisit at least 1.6325, and that the uptrend may be over.