GBP/USD Signal Update

Tuesday's signals were not triggered and expired.

Today’s GBP/USD Signals

Risk 0.50%.

Entry should be made between 8am and 5pm London time today only.

Long Trade

Enter long with a limit buy order at the first touch of 1.6400.

Stop loss at 1.6360.

Take profit on 50% of the position at 1.6449, move the stop loss to break even and let the remainder of the position ride.

Short Trade 1

If the price reached 1.6560 during the hour between 7am and 8am London time, enter short at market if the price breaks 1 pip below that hour's low before Noon London time.

Place the stop loss 1 pip above the day's high and take profit at a reward to risk ratio of 1:1.

Short Trade 2

Enter short at the next bar break of an hourly pin bar rejecting and closing below the resistance level of 1.6619. If this level is not touched and rejected by the same hourly bar, or if an hourly bar closes more than a few pips above this level, the trade is immediately invalidated and should not be taken.

Stop loss 1 pip below the local swing high.

Take profit on 75% of the position at 1.6505, move the stop loss to break even and let the remainder run.

Note: if both of the short trades are triggered, only take the first one.

GBP/USD Analysis

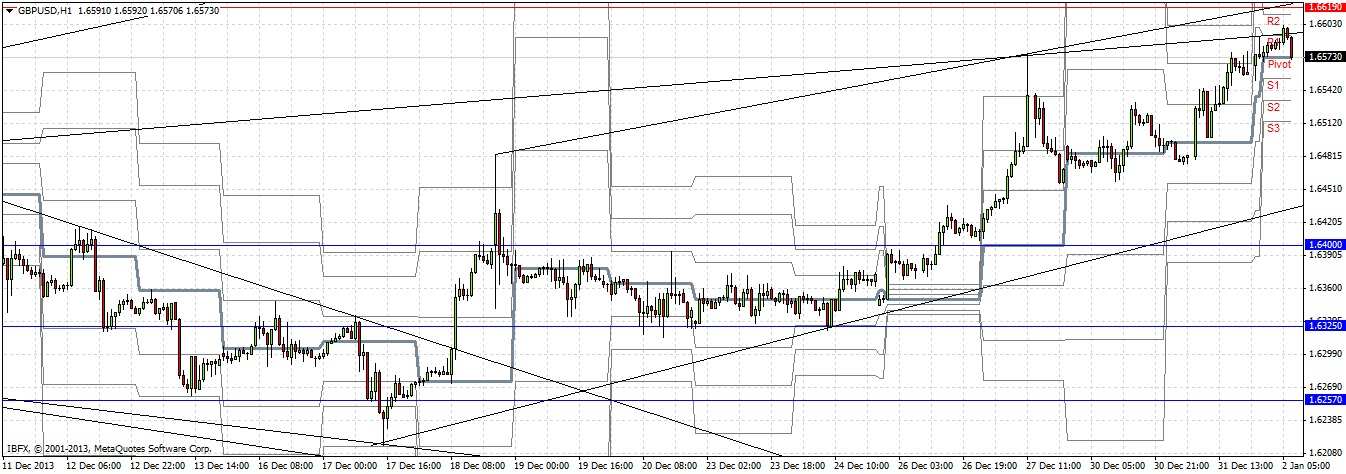

The uptrend in this pair was quietly maintained over the Christmas period with bullish trend lines holding, before spiking upwards dramatically on Friday to reach a new high. Although the price quickly retreated from this spike, I agree with Christopher Lewis’ belief that the line of least resistance is still currently upwards. Having said that, there is an old support turned resistance level from May 2011 at 1.6619 that could be likely to hold, and today it is confluent with a trend line, as can be seen in the chart below, so I am prepared for a short trade from this level.

It is a little hard to see, but Friday’s price action flipped resistance at around the 1.6400 level to support. This is confluent today with a bullish trend line, which should be supportive. The pair continued to rise quite strongly yesterday but has fallen a bit this morning during the end of the Asian session.

The H4 candle closing at London time is currently looking like it may form a bearish outside bar. This indicates a probability of a further fall if its low is broken before Noon London time, but I do not give it as a signal unless it reached 1.6560 before 8am London time.