GBP/USD Signal Update

Yesterday’s signals were not triggered and expired.

Today’s GBP/USD Signals

Risk 0.50%.

Entry should be made between 8am and 5pm London time today only.

If you can take the risk off any open trade at Noon London time today, do so.

Long Trade 1

Enter long with a limit order at a touch of 1.6325.

Stop loss at 1.6285.

Move the stop loss to break even at 1.6365 and take 50% of the profit at 1.6397. Leave the remainder of the position to run.

GBP/USD Analysis

This pair has shown considerable suppressed bullishness and the suppression is due to the important news releases that are almost upon us.

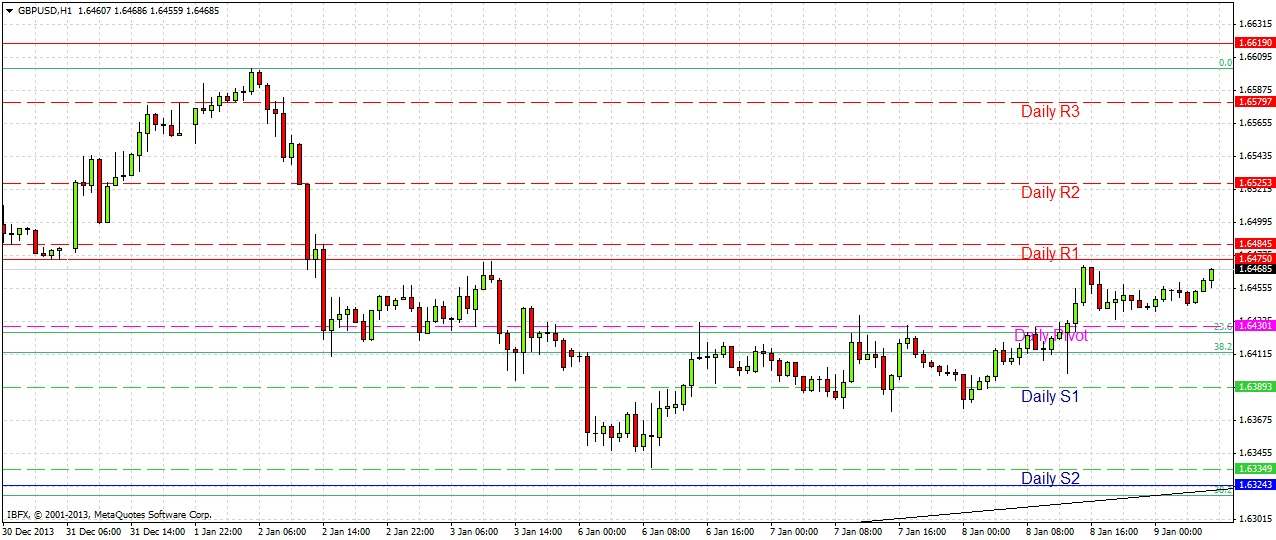

The low of Monday’s bullish pin bar has held, the bullish trend line below has held, and we are established within a bullish channel that began last July. A higher high was made Tuesday and again yesterday when we saw a bullish breakout of the 1.6433 level by a large bullish pin bar the formed on both the 1 hour and 15 minute charts. The price moved up quite quickly to hit the R2 pivot at 1.6470 but was unable to penetrate the resistance at 1.6475, which has held.

Therefore everything seems poised for a move up, and as can be seen from the chart below, the level below us at 1.6433 seems to have become resistance turned into support:

For these reasons I am not prepared to look for a short today.

The support level at 1.6325 looks very good, it is confluent with a fairly long-term bullish trend line and also today’s S2 daily pivot level, as well as a Fib retracement level of 38.2% of the upwards leg since November.

There is very important news later today at Noon London time for the GBP (Asset Purchase Facility, Official Bank Rate, MPC Press Statement) and for the USD also at 1:30pm (Unemployment Claims). The pair is almost certainly going to have an extremely active New York session, but will probably remain fairly quiet beforehand.