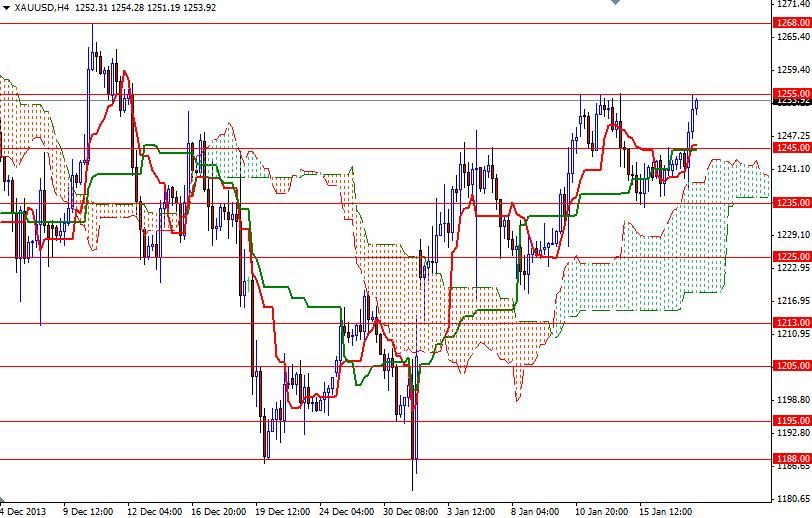

The XAU/USD pair (Gold vs. the American dollar) scored a gain of 0.94% on Friday as mixed economic data out of the United States continued to lure some investors back to the market. The pair broke above the 1245 resistance level, which has been a cap on prices for the last couple of days, after building permits and housing starts number came out weaker than forecasts. In my previous analysis I had pointed out the importance of this resistance level. Not surprisingly, the pair accelerated its ascend right after we climbed above this barrier and traded as high as 1254.82.

Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold (for the fourth consecutive week) to 44013 contracts, from 38887 a week earlier. From a technical perspective, I think the market ended the week at a very interesting point because the Ichimoku cloud (on the daily chart) is just above us and also intersecting with the top of the descending trend line dating back to September. If the XAU/USD pair breaks through the cloud, there could be a run all the way back to the 1307/15 area.

Beyond the 1255 level, expect to more resistance at 1268 and 1277. To the downside, there will be support at the 1245 and 1235 levels. If the bears take over and pull prices below 1235, I think 1225 will be their next targets. A daily close below 1213 will likely mean a stronger bearish push downward is on its way.