Gold continued to gain ground against the American dollar during Friday's session and closed the week at $1268.50 an ounce, the highest level since November 20. Soft economic data out of the United States and the recent weakness in the American dollar has been providing support for safe-haven gold. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold (for the fifth consecutive week) to 46583 contracts, from 44013 a week earlier.

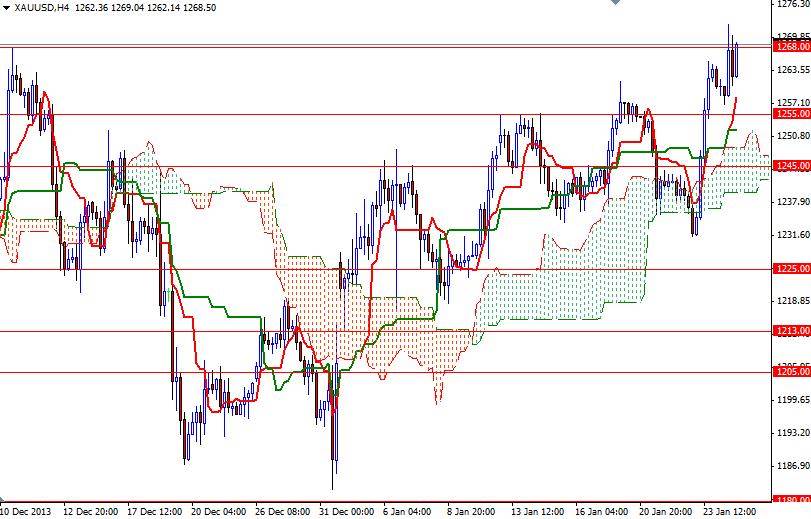

The XAU/USD pair had accelerated its ascent on Thursday after the bulls managed to clear the 1255 resistance level which had been blocking the bulls' advance for the past eight days. From a technical perspective, that is a positive sign but the Ichimoku cloud indicates a good area of support or resistance depending on its location therefore climbing above the cloud (the daily chart) which converges with the Fibonacci 38.2 level based on the bearish run from 1433.70 to 1182.35 is essential for a bullish continuation.

Sharp drops in the major stock markets and the USD/JPY pair looks supportive for gold at the moment, however, traders might be reluctant to take sizable positions ahead of ahead of the Federal Open Market Committee's two-day policy meeting which begins on Tuesday. Last year, the gold market ran ahead of itself to price in a bright U.S. economy and continuous tapering of asset purchases. If the bullish momentum continues, resistance can be found at 1278 and 1286. Only a daily close above 1286 would make me think that the XAU/USD pair is going to test 1293 and 1307 next. If the pair encounters heavy resistance and reverses, expect to see support at 1255/8, 1245 and 1235.