The XAU/USD pair (Gold vs. the American dollar) scored a gain of 0.84% on increasing demand for protection against the trouble in emerging markets. The pair traded as high as 1270.05 even after the Federal Reserve announced that it will trim monthly purchases by another $10 billion to $65 billion. The Federal Open Market Committee said “If incoming information broadly supports the Committee’s expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings.

However, asset purchases are not on a preset course, and the Committee’s decisions about their pace will remain contingent on the Committee’s outlook for the labor market and inflation as well as its assessment of the likely efficacy and costs of such purchases” at the conclusion of a two-day meeting yesterday. The Fed's action shows that officials want to exit from asset purchases as soon as they can despite recent turmoil in emerging markets. Although the existing pullbacks in stock markets helped providing a lift to gold in the short term, I expect the fact that monetary stimulus by the Federal Reserve is coming to an end to maintain constant pressure on the market in the long run.

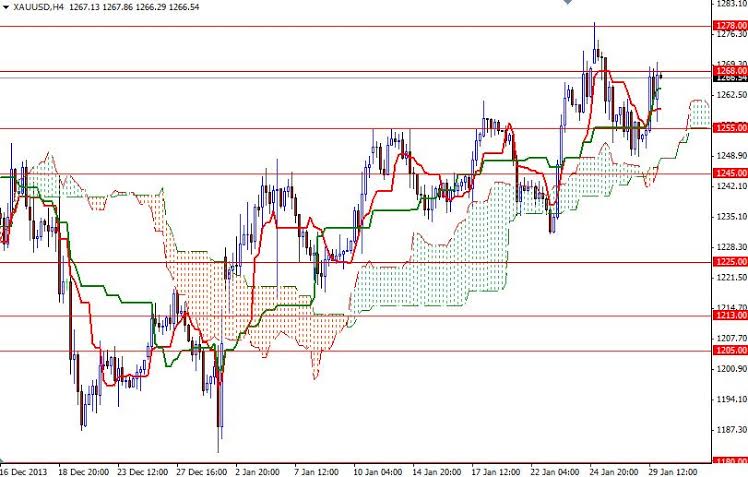

From a technical perspective, the first hurdle gold needs to jump is located around the 1268 level. If the bulls manage to push and hold prices above this level, it is likely that the XAU/USD pair will test the 1275 - 1278 zone where the top of Ichimoku cloud on the daily time frame and Fibonacci 38.2 level reside. Once above that, the bulls will be targeting 1286 next. If the pair fails to break through 1268 and reverses, there will be support at the 1255 level. If we drop below that, look for 1248.41 and 1245.