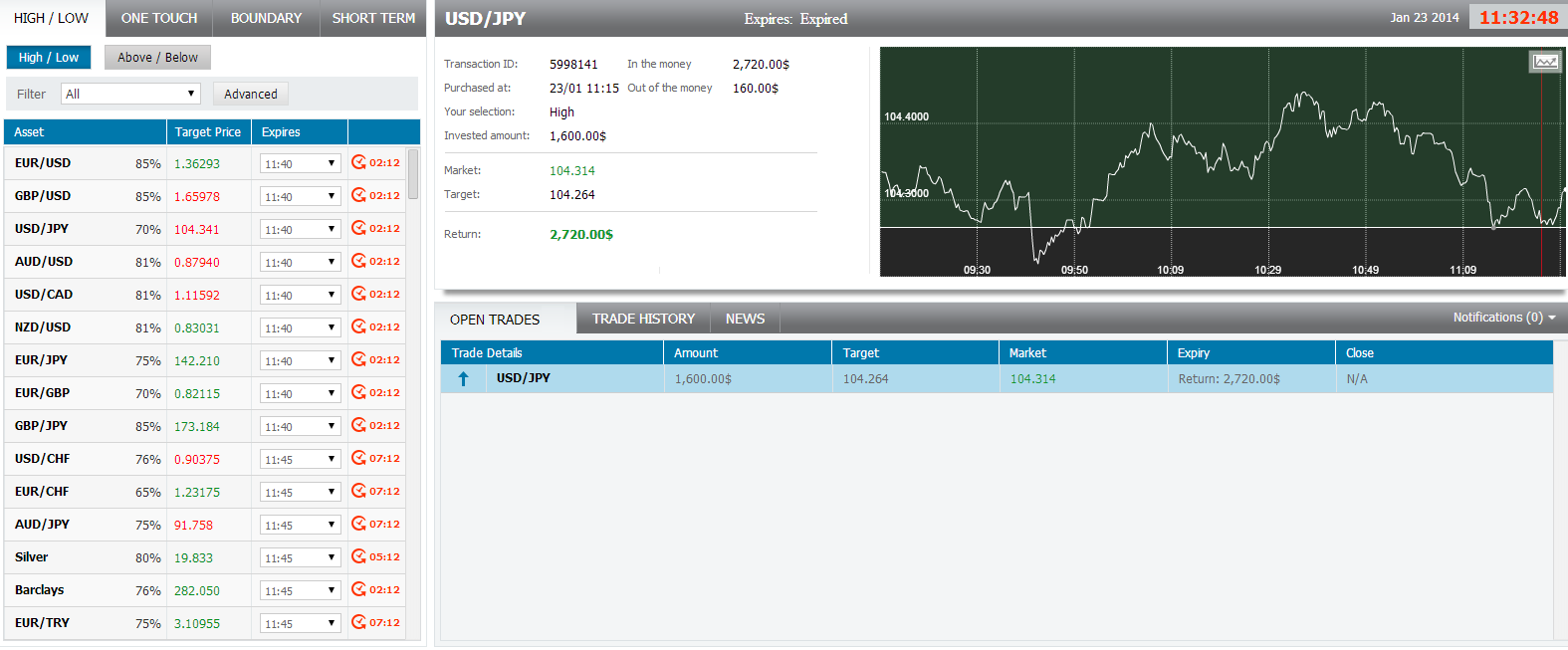

USD/JPY

According to Christopher Lewis’s analysis of the USD/JPY, “As the Bank of Japan continues to work against the interest-rate differential and therefore the Yen, I believe that this market will continue to find plenty of reasons to go higher, regardless of any noise above”. That creates an investment opportunity on the instruments: “High”, “Touch” and “No Touch down”.

I logged in the OptionFair™ binary options trading platform and I traded $1600 on the "High" instrument. This kind of option has a return of 70% if the option will close above the target price, which means that if the signal is correct I could get a return of $1120 on my investment.

The market price for USD/JPY at the buying time (11:15) was 104.264 for the expiration of 11:30. The Asset closed on 104.314 and I made $1120.

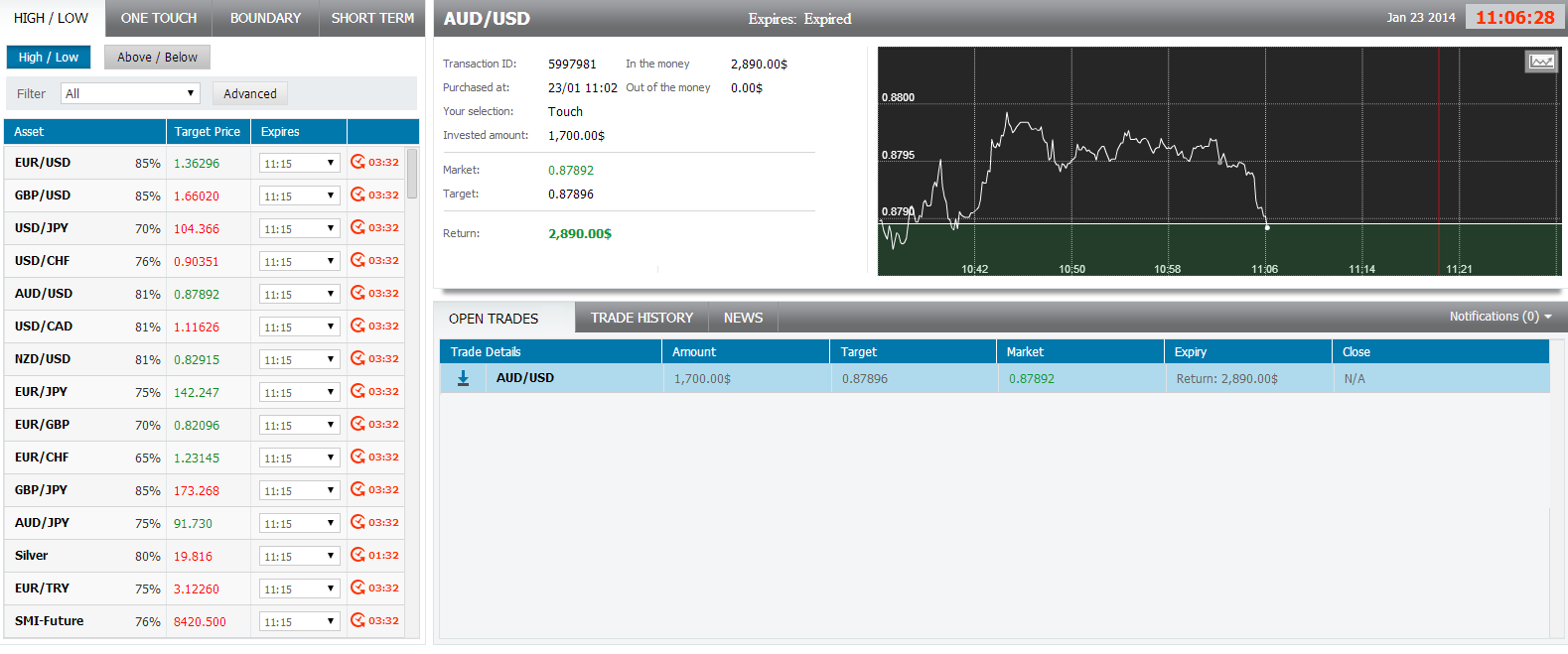

AUD/USD

Based on Christopher Lewis's analysis of the AUD/USD: “With that, I believe that this market will start selling off, possibly based upon short-term trading”. That creates an investment opportunity in the following positions: “Low”, “No Touch” and “Touch Down”.

With OptionFair™ binary options trading platform, I traded $1700 on the “Touch Down” instrument. This kind of option has a return of 70% if the option touches the strike price prior to expiry, which means that if the signal is correct, I could get a return of $1190 on my investment.

The market price for the AUD/USD at the buying time (11:02) was 0.87954 and the target price was 0.87896 for the expiration of 11:30. The Asset touched my target price at 11:06 and I made $1190 in four minutes.