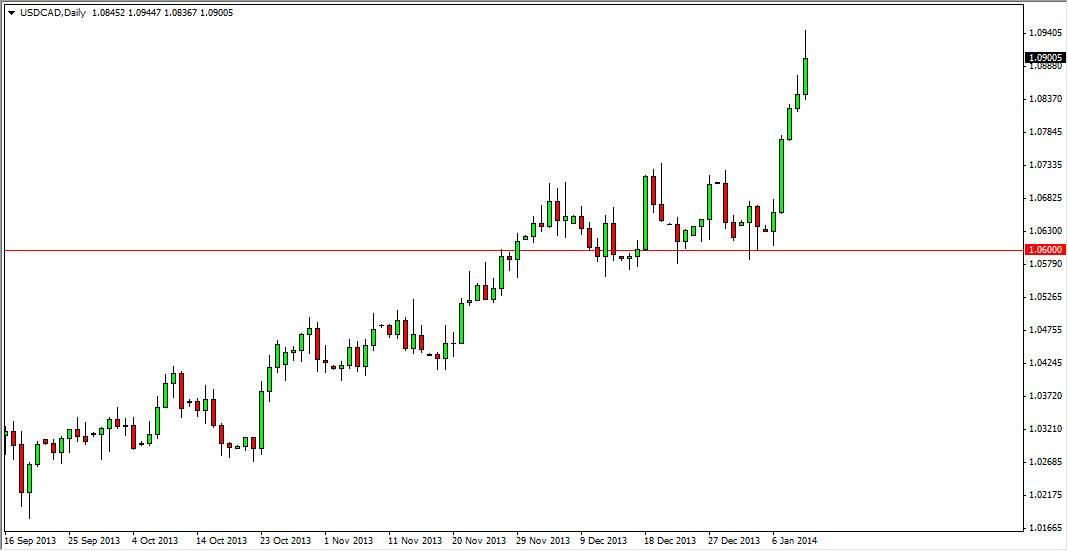

The USD/CAD pair rose again during the session on Friday, boosted mainly upon the weaker than anticipated Canadian jobs numbers. The nonfarm payroll numbers out of the United States were weak as well, but they were the “lesser of two evils”, if you will. On top of that, the oil markets has not been helping the Canadian dollar at all, and I believe that we are going to continue going higher given enough time. In fact, I still hold the target 1.10, which of course isn't that brave of a call at this point, but have maintained that opinion for some time now. The real question then becomes whether or not we can get above that level?

Nonetheless, the candle on Friday did get back about half of the gains so I have to wonder whether or not there is a potential pullback coming. A pullback would make sense, because we have gotten so overbought recently that this move is starting to become somewhat parabolic. That being said though, you have to keep in mind that this pair has a long history of going sideways and then suddenly exploding in one direction or the other.

Continued US dollar strength against commodities?

Pay attention to the commodity markets, they may determine what happens with several of the major pairs that we trade. Oil of course has a massive effect on the Canadian dollar, but in reality the question then becomes about employment. If employment is weaken the United States, can they possibly expect to see a lot of demand for energy out of that same country? The answer of course is now, so in a roundabout way it makes sense that this pair continues to go higher.

Because of this, I will continue to buy this market on pullbacks in show signs of support, mainly using the short time frames. That being the case, I think a lot of traders will look at this market as one that is obviously bullish, and therefore every time we pullback we should have people wanting get involved that may have missed the initial move.