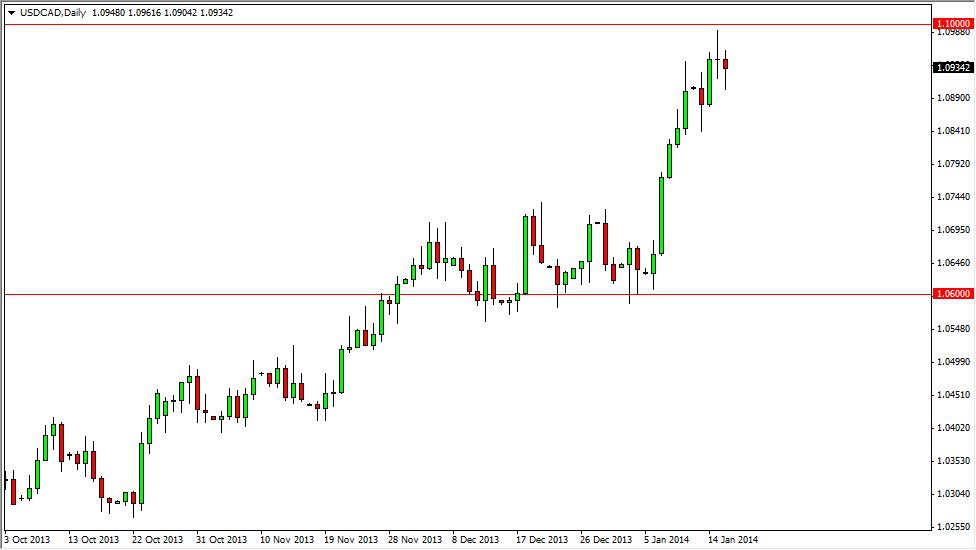

The USD/CAD pair had a slightly negative session on Thursday, but what I found most interesting is the fact that we both the bottom of the shooting star from Wednesday, but could not fall below the 1.09 level for any length of time. This to me suggests that the market is going to continue to find buyers every time it pulls back, and instead of following any significant amount of time, I believe that this market is more than likely going to go sideways. This is one of the two continuation patterns you normally see after a parabolic move like we’ve had, as buyers simply take a rest, but nobody’s willing to start selling.

The Canadian dollar has had its bad news recently, and it seems like the hits keep coming. The jobs number out of the United States was rather poor last week, but it wasn’t anywhere near as bad as the Canadian employment numbers. That being the case, Canada suffers the double whammy of not only having a weakening economy, but having its largest customer looking for jobs. After all, if your largest export market is showing signs of weakness, there really isn’t much of an export market to be had.

Oil markets looking weak.

Oil markets look weak at the moment as well, and that certainly will not help the Loonie gain against the dollar. Although it looks like the market may go sideways, and it could even possibly pull back slightly, I am still very bullish of this pair. I believe the 1.10 level will of course offer psychological resistance, as well as technical resistance based upon longer-term charts, it’s only a matter time before we break above that level. Doing so would be significant on a couple of different levels.

First of all, you would break above the psychological resistance, secondly, you would break above an area that has caused problems in the past. And perhaps even most important, we would be breaking above the top of the shooting star, which of course is one of my favorite bullish signs.