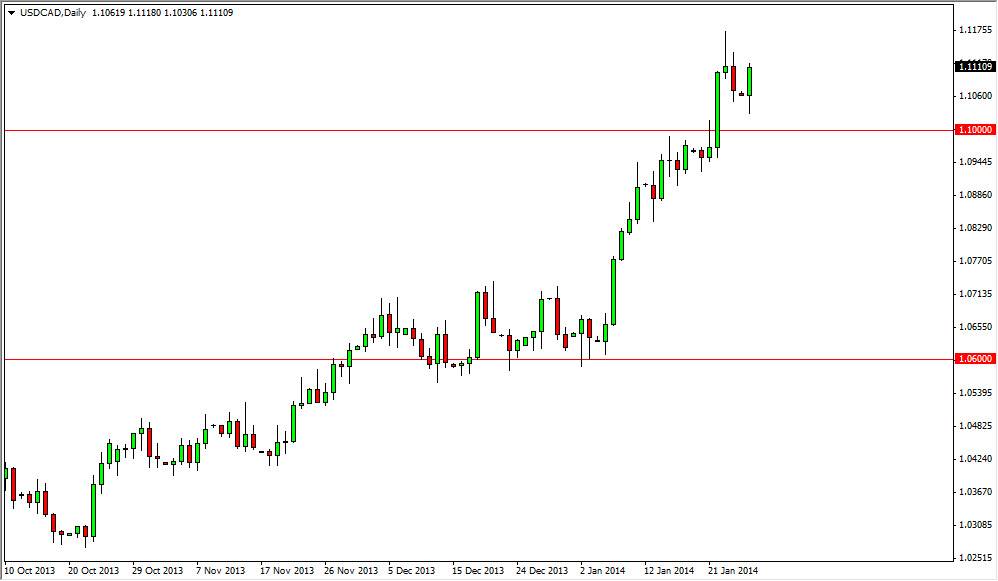

The USD/CAD pair initially fell during the session on Monday, but as you can see found enough support above the 1.10 level in order to turn back around and closed the day with a positive candle. This positive candle of course shows real signs of strength as we are closing towards the very top of the range, and above the 1.11 level. This market has been very bullish, and the fact that we formed a shooting star a couple of days ago was probably a sign that the market had been a little overdone at that point, but as you can see below the 1.10 level there is a significant amount of movement that keeps the market well supported.

I am a firm believer in the strength of this move, and believe that ultimately the market will grind its way higher. This might not be this move this move ever, but quite frankly this pair has a long history of grinding sideways and then suddenly moving in one direction or the other. With that being the case, it would not be a complete surprised to see a little bit of consolidation in this area as the 1.12 level has been resistive.

FMOC meeting and oil prices.

The FMOC meeting this week of course will take front stage in the Forex markets. On top of that, it will have a strong influence on what goes on in the oil markets, which almost always has a strong influence on what goes on in this market. With that, there are a lot of moving pieces in this particular market, and the fact that the two economies are so intertwined of course does not help the tuition as far as clarity is concerned. However, I think it’s obvious that the trend is from the “lower left to the upper right”, and therefore that’s really what matters.

I understand that longer-term this is a downtrend, but breaking above the 1.10 level was in fact significant on a longer-term perspective as well. Because of this, I am still firmly bullish of this pair but do expect a fight going higher.