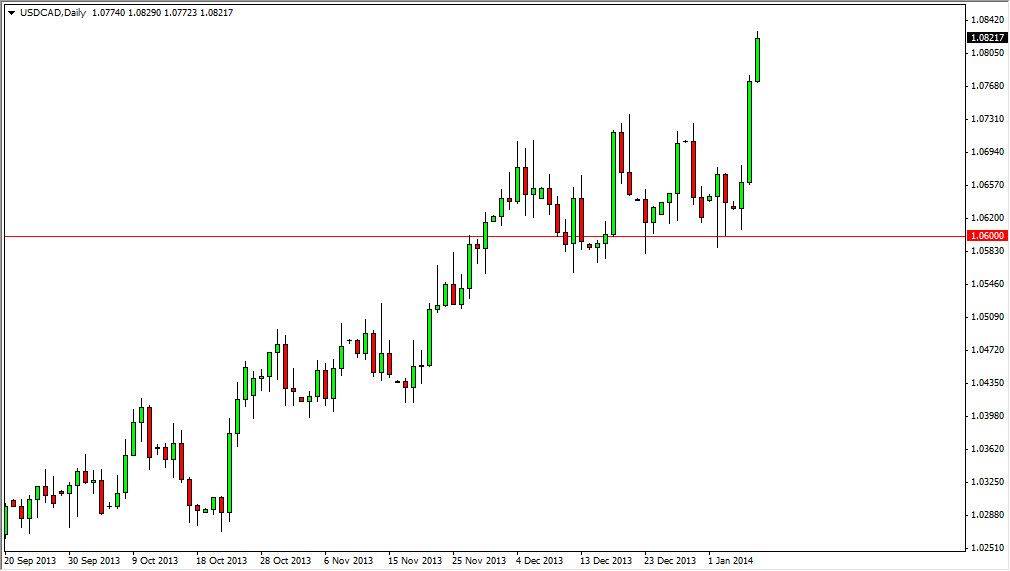

The USD/CAD pair had another bullish session on Wednesday, breaking above the 1.08 handle. Quite frankly, this is one of those pairs is that goes parabolic at the drop of a hat. We spend a lot of time going sideways in this market, and then will eventually break in one direction or the other. It is because of this that I’m not as concerned about buying into a parabolic move in this market as I would be many other currency pairs. This is mainly because the two markets are so interconnected that most of the time there’s a certain amount of “parity” between the two currencies as the Canadians send 85% of their exports down to the United States. Simply put, the Canadians need the Americans in order to have their economy function a healthy matter.

All things being equal though, oil is the main factor in the value of the Loonie. Because of this, looking over at the WTI Crude Oil markets you can see that the selling of oil is coinciding quite nicely with the selling of the Canadian dollar. Given enough time, this correlation typically continues, and that’s something that I fully expect to see.

92.50 is probably the most important number for this market.

The $92.50 level in the WTI Crude Oil markets is probably the most important number for this currency pair right now. If we break down significantly below that area, I think that the oil market will go down to the $90 level, which could very easily send this pair up to the 1.10 handle, which of course is the target that I’ve been talking about for some time as the longer-term charts show nothing of significance between here and there. That’s the beauty of the correlation between this market and the oil markets, that one will typically lead the other. Perhaps we are seeing the currency markets leading the futures markets at the moment. Nonetheless, the US dollar is strong against just about everything out there right now, so certainly selling is an even a possibility as far as I can tell. Buying short-term pullbacks could be a strategy though.