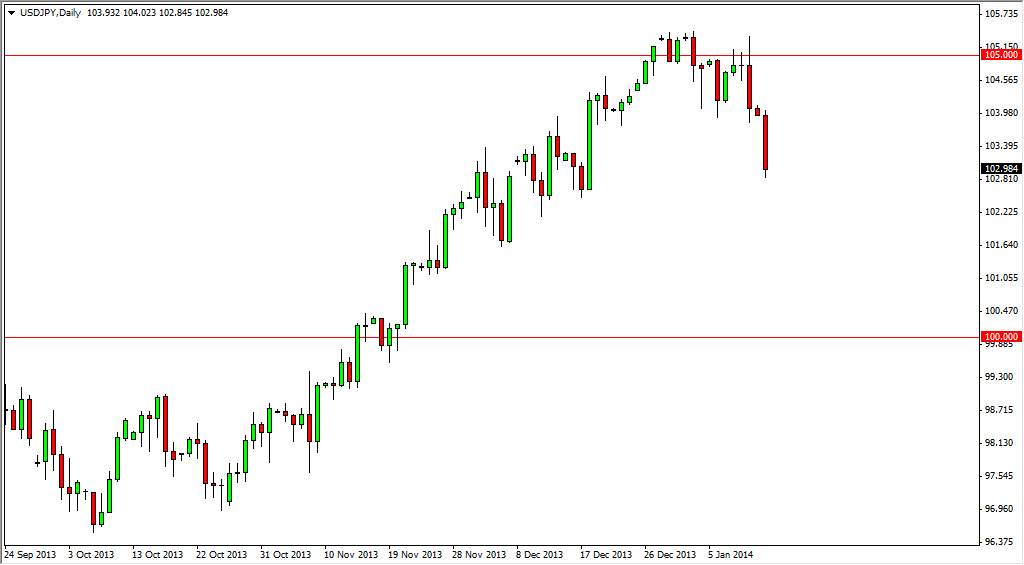

The USD/JPY pair fell during the session on Monday, testing the 103 level. The candle of course looks very weak, but at the end of the day I still believe that this market is most certainly and an uptrend. Yes, I understand that the nonfarm payroll number was very discouraging, but in the long run the interest-rate differential will still favor the US dollar given enough time. The Federal Reserve is much closer to tapering off of quantitative easing with significance than the Bank of Japan is by any stretch of the imagination, so this of course favors the US dollar anyway.

No economic recovery is a straight line up, and as a result worrying too much about the American economy is probably going to work against you. After all, the Japanese are looking very seriously into weaken the value of the Yen as much as humanly possible. They have started monetary easing recently, and are nowhere near turning that around. On the other side of the Pacific, the Federal Reserve has already tapered wants. There’s a good chance of they will have to taper again, and as a result that should continue to give a boost to the US dollar.

Buying opportunity.

I believe that this pullback in the end will be considered to be a nice buying opportunity. After all, the market has marched relentlessly higher, and as a result some type of pullback or at least rest is probably needed. I recognize that the 103 level is the beginning of significant support all the way down to the 102.50 level, and most certainly the 100 level will be supportive as well as it is such a psychologically significant handle.

With that being said, I am waiting for some type of supportive candle below in order to start buying again. I have a core position long in this market for much lower levels, and I’m always looking for reasons to add to my position. I believe that ultimately this market will continue to go higher over the course of 2014, easily heading the 110 level.