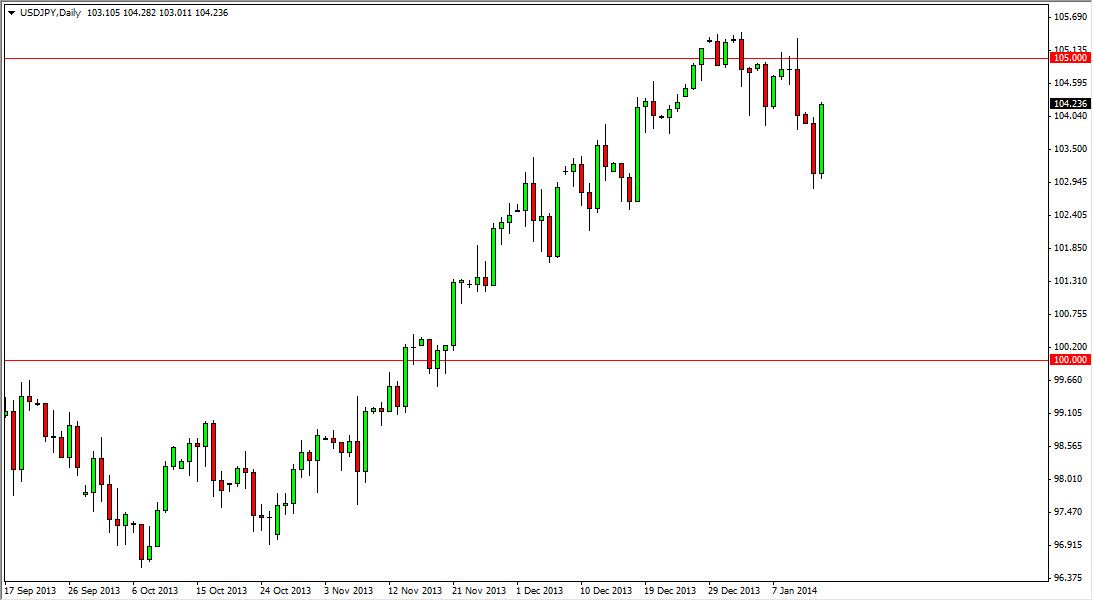

The USD/JPY pair rose during the session on Tuesday, completely wiping out the losses that the market had experienced on Monday. The candle is long, tall, and green, all of which signify that we should see continued momentum to the upside. The fact that we are closing above the 104 level is strong two, as we start to take on the 105 level yet again.

I believe the 105 level is a thick resistance area, and actually doesn’t end until we get to the 105.50 level. With that being the case, I need to see fresh new highs broken in order to start buying again, but I do think that it’s not going to take that long. In fact, I still fully believe that we are heading to the 110 level given enough time, but little hiccups and pullbacks should be expected. After all, the weaker than anticipated jobs numbers out of the United States last week did absolutely nothing to help the buyers in this market.

The Bank of Japan is still your friend.

The Bank of Japan is still your friend if you are long of this pair. No matter if the Federal Reserve can taper off of quantitative easing quickly or not, the Bank of Japan is still willing to step in and devalue the Yen anytime it can. After all, the Japanese have a massive amount of exporting they wish to do to keep the economy afloat, and as long as that’s the case the central bank will try to keep their currency relatively weak.

On top of that, Japan has one of the world’s largest aging populations. Because of this, bonds being paid back in Yen need to be devalued and the quickest way to do that is to pay them back in devalued currency. This is a fight between two central banks are absolute masters at wiping out the value of their own currencies, and as the Federal Reserve is starting to see a possible pick up in the United States, I am more than willing to bet that the US dollar continues to go higher.