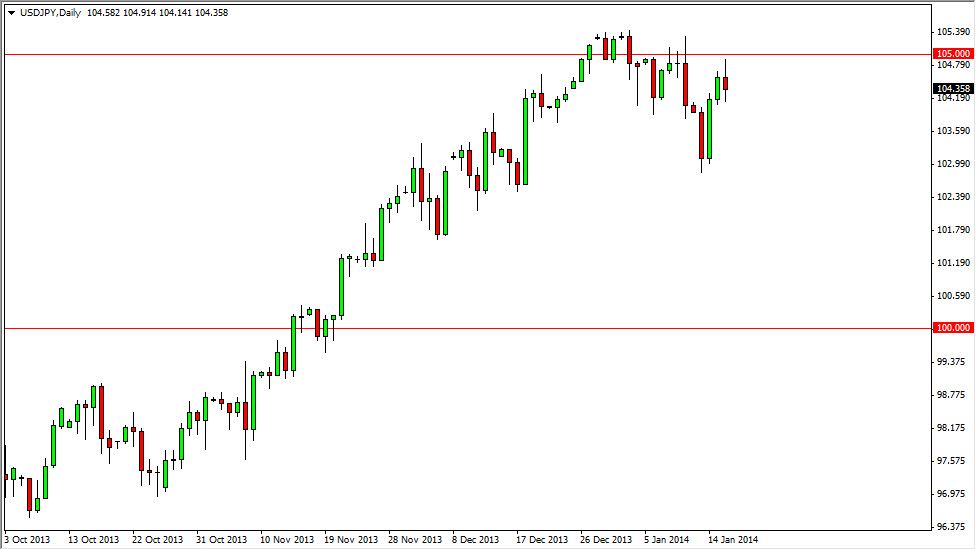

The USD/JPY pair try to rally above the 105 level during the session on Thursday, but was left wanting as you can see. The resulting candle is a shooting star, and of course that is a very bearish sign. That makes a lot of sense, simply because of the poor jobs numbers out of America will have traders thinking that the Federal Reserve may stand firm for a while when it comes to quantitative easing and the tapering of it. However, I believe that this is only a temporary setback, and even though we have a bearish candle, I am not willing to sell this pair as I believe ultimately it does go much higher given enough time.

That being said, I look to the charts and see the 103 level as being a very supportive area. I would love to see a pullback to that area and a supportive candle in order to start buying and what I would consider to be a “value play.” With that being the case, it’s only a matter of time before the buyers will step in any way, as we have had such a bullish run higher.

Jobs numbers will continue to push this market more than anything else, but pay attention to the Bank of Japan as well.

As I stated above, jobs numbers will continue to be one of the most important factors in this pair. After all, the more jobs of the Americans produce, more likely the Federal Reserve is to taper. This pair tends to follow the differential of interest rates in the ten-year note market, with money flowing in the direction of the economy paying more in the way of yields. There does seem to be a shift in the direction of money flow across the Pacific recently, as it now finds itself going from left to right in favor of the Americans. The Japanese are perfectly fine with this, so expect the Bank of Japan to jawbone the value of the Yen down if this pair service the fall. Because of this, I believe that there is essentially a permanent bid in this market.