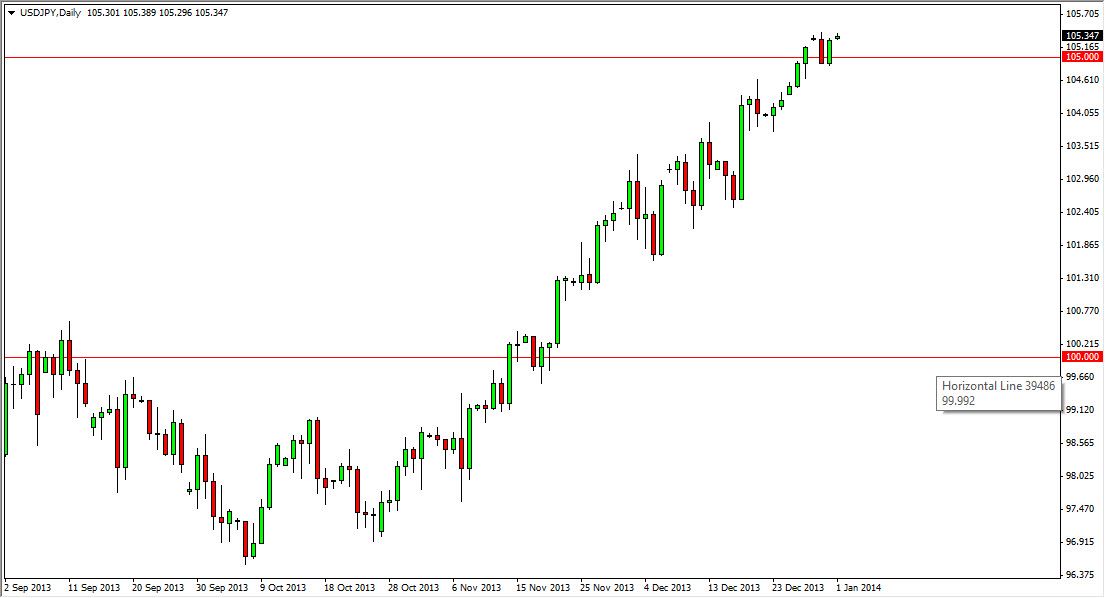

The USD/JPY pair rose during the last session of 2013, and at the late opening on January 1, you can see that the markets continue to show somewhat of a bullish stance. I believe that breaking above the 105 level was significant, and that the area should offer support going forward. Because of that, I am not hesitating to add to my long position already, and continue to be long of this pair for longer term trading as well as short.

That being said, there will be pullbacks. Those pullbacks should offer plenty of buying opportunities though, as I believe that we are ultimately going to break out massively to the upside. That should be a longer-term move, and I believe one that a lot of careers will be made from. After all, this market is starting to look more and more like the move that we saw right around 2001, when the market started to take off to the upside again. This has the feel of a market that’s ready to get over exuberant yet again, and a lot of money can be made in a market like this as there’s really only one way to trade it, simply by it every time it falls.

Central banks

Keep in mind that the central banks from both of these countries are on two distinctly different paths. The Bank of Japan has just started to aggressively ease its monetary policy, while the Federal Reserve has started to taper off of its quantitative easing. Because of this, we will eventually see interest-rate differentials in the ten-year notes widen yet again, and that is one of the main drivers of this pair. Money likes to fly into the bond markets, because is considered to be the most reliable market. Keep in mind that even though the Forex markets are the largest in the world, not all of its speculation. Some of it is simply buying another countries bonds, which is where a lot of the big money flows. If there’s more of an interest-rate offered in the United States, then this pair will continue to rise. I believe this will be the case for the next several years.