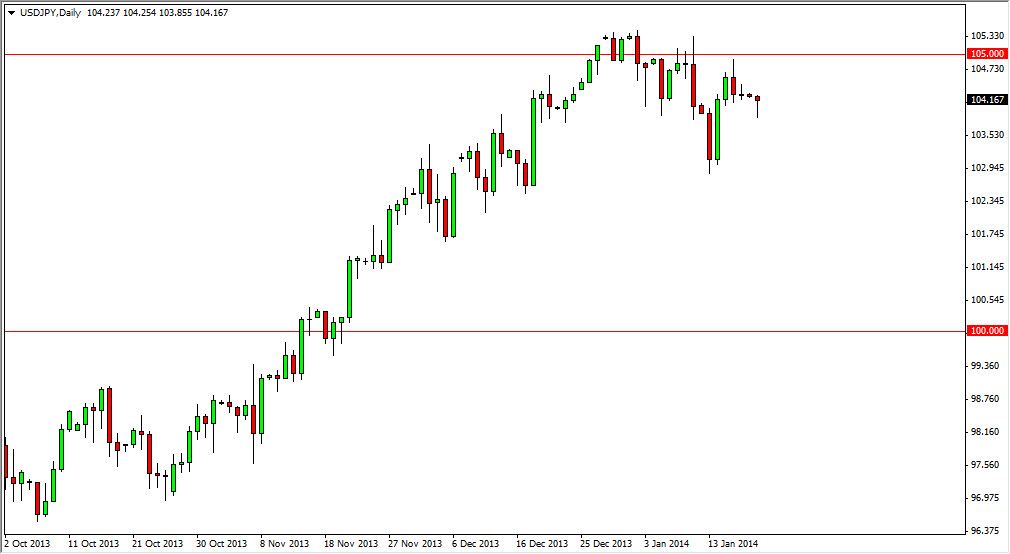

The USD/JPY pair has been one of my favorites for some time now. One look at this chart, and it’s obvious why. It’s one of the few markets that has been such a nice steady move higher, and as a side note I should say that it’s basically the JPY selling off that has been driving this market. Granted, you do have the situation where the Federal Reserve has tapered off of quantitative easing a bit, but in the end it’s probably more to do with the Bank of Japan’s stance as it continues to opt for a weaker currency. With that, it’s very easy to imagine a situation where the Yen continues to fall against most major currencies.

This market is the first place that you generally see the attitude of the Yen show up, as it is by far the most liquid Yen-related pair. With that, it’s always the first one I look at when I think about trading the Japanese currency, even if it’s not the market I actually get involved in.

Hammer

The fact that Monday formed a hammer suggests to me that the market still has plenty of buyers underneath it, and that’s what you want to see after such a nice trend higher. After all, we have had a little bit of a breakdown, and the fact that buyers are willing to step in does in fact reinforce the idea that this pair is going to go higher over the longer term. Full disclosure, I am short of the Japanese yen against several different currencies right now, with somewhat mixed results as some of the currencies I have shorted against are very high risk. However, I believe that Yen weakness is something that we are going to continue seeing, and this hammer of course doesn’t hurt that opinion.

A break above the top of the hammer has this market looking for the 105 level, which leads the way to the 105.50 level, which is significant. If we can get above the 105.50 level, I believe we will eventually head 110. That’s my base case scenario anyway, so quite frankly that’s what I’m looking for.