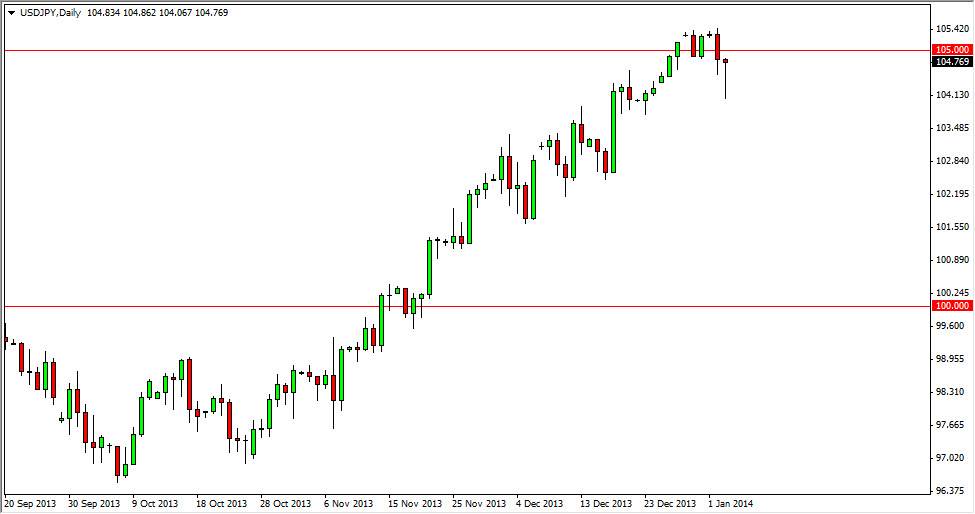

The USD/JPY pair has been one of my favorites for some time now. This pair looks like it’s ready to start a massive multi-year uptrend, and quite frankly the fundamentals seem to support that type of move, given enough time. The candle on Friday was very interesting, we plunged down to the 104 level, but found quite a bit of buying down there in order to push the market up and form a very strong looking hammer. This hammer suggests that the market is going to launch from the 105 level, something that I’ve been thinking for some time.

I believe that if we can get above the recent highs at roughly 105.40 or so that this market will head to the 110 level eventually. I also believe that we will go much higher than that if you are a longer-term trader. After all, the central banks are diametrically opposed as far as their actions, and we may find that the Federal Reserve has to taper off of quantitative easing much quicker than anticipated.

Central banks and their effect on this pair.

The Bank of Japan of course has just recently started an aggressive easing policy as far as money is concerned. The Japanese yen is far too overvalued for their liking, and it’s absolutely crushing the export sector of the Japanese economy, something that is extraordinarily vital for that country. On the other side of the Pacific, you have the Federal Reserve which is just announced a slight tapering off of quantitative easing, and that sent the value the US dollar much higher. I believe that the jobs numbers will continue to be scrutinized buying the members of the FMOC, and if they continue to get good numbers, they will have to taper off of quantitative easing, thereby driving the interest-rate differential much higher in the bond markets. After all, this pair does tend to follow the ten-year notes and the interest-rate differentials between the ten-year notes of the two economies. Ultimately, I believe that careers are going to be made by going long of this pair, and I most certainly am at the moment. In fact, I am short the Yen against most currencies right now.