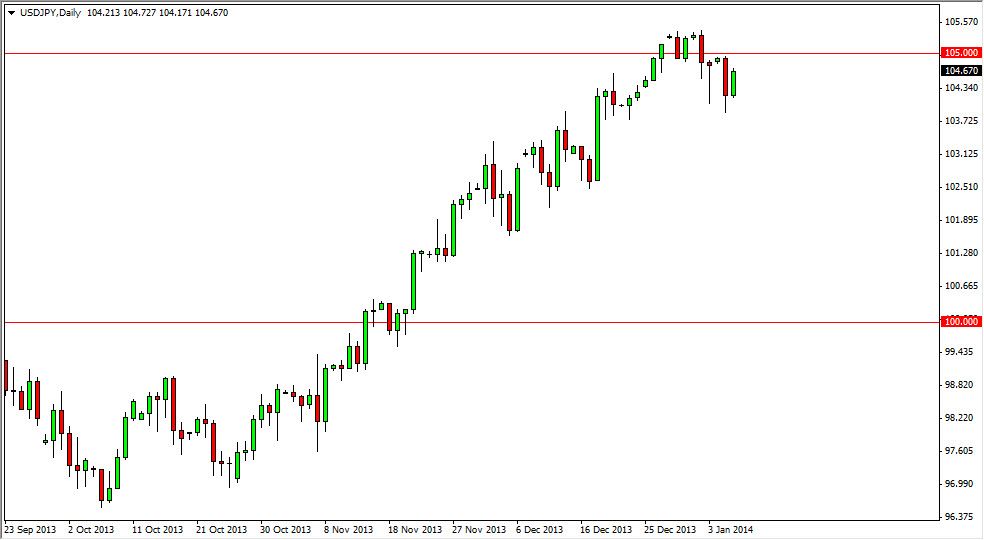

The USD/JPY pair managed to rally during the session on Tuesday, reclaiming the losses that we had seen in the market on Monday. That being the case, we are still below the 105 level, and that seems to be a magnet for price right now. That makes sense, as it is a large, round, psychologically significant number, and the fact that the nonfarm payroll numbers are just a couple of days away. Remember, this pair tends to be very sensitive to that economic announcement, and will be “the place to be” after that announcement.

If we can get some type of push above the 105.50 level, this market should continue to go to the 110 level given enough time. I believe ultimately this is going to happen, but with the uncertainty of the jobs number coming it might be premature to enter the position at the moment. Having said that, I would necessarily fear going long at this point, I just don’t think it would be the most efficient entry.

Nonfarm payroll numbers.

If the jobs number in the United States comes out stronger than anticipated, that should be very strong for the US dollar as it signals that the Federal Reserve might be able to begin tapering again. After all, the last tapering announcement wasn’t exactly stunning, although it was a step in the “right direction.” I mean by that is the value the US dollar started to increase, but the Federal Reserve also took the stance that interest rates would remain low for longer than originally anticipated. That of course puts a bit of a ceiling above the value of the US dollar, but in this pair is a little bit different as the Bank of Japan is working so feverishly against the value of the Japanese yen.

This could be the market that really takes off after a strong jobs number. However, if the number is very weak, this pair could get hit rather hard wearing would be looking for support at lower levels. As I stated previously, I believe this pair goes higher given enough time anyway. With that in mind, I am looking at any potential selloff as a value play as well. I have no plans whatsoever to sell this pair.