USD/JPY Signal Update

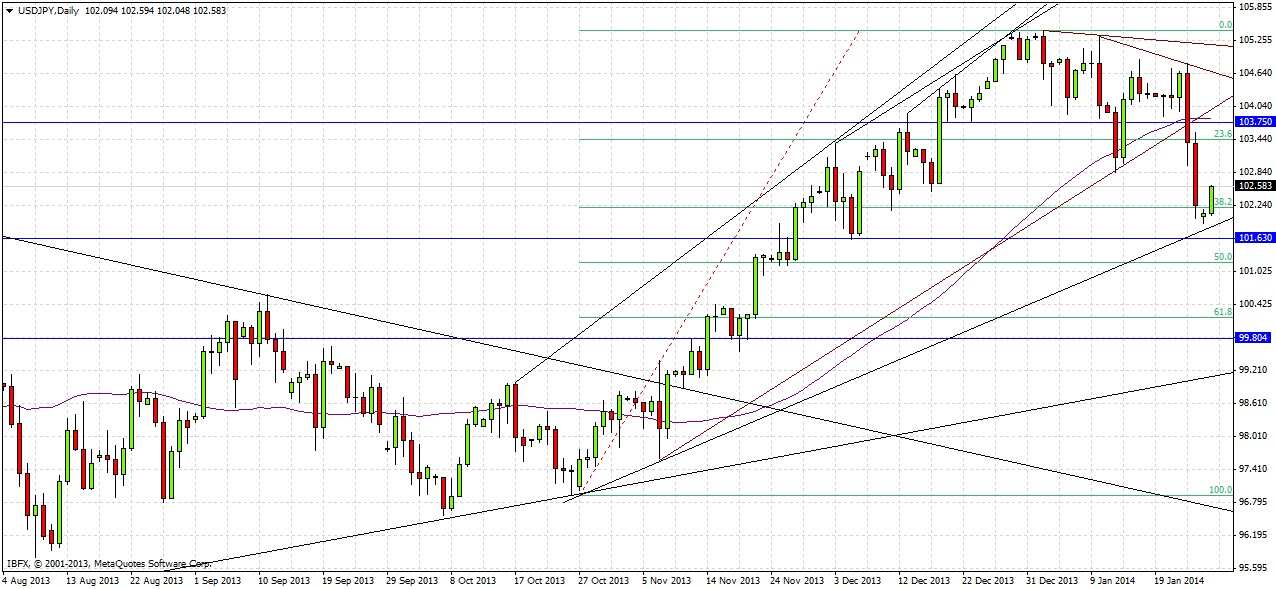

Last Thursday’s signal were not triggered and expired. The price did reach the zone between 103.91, but after some hesitation blasted downwards right through it and the long-term bullish trend line, proving it was sensible to wait for price action confirmation in this case.

Today’s USD/JPY Signal

Long Trade 1

Enter long if a pin or engulfing bar is formed on the hourly chart when the price first reaches 101.63, on the break of the bar by 1 pip on the next bar. If a bar closes below 101.60, the trade is invalidated.

Stop loss at the local swing low.

Move the stop loss to break even when the trade is 25 pips in profit. Take 50% of the position as profit at 102.70 and leave the remainder of the position to run to 103.75.

Risk 0.50% and the trade may be taken until 8am London time tomorrow.

Short Trade 1

Enter short if a pin or engulfing bar is formed on the hourly chart when the price first reaches 103.75, on the break of the bar by 1 pip on the next bar. If a bar closes above 103.75, the trade is invalidated.

Stop loss at the local swing high.

Move the stop loss to break even when the trade is 25 pips in profit. Take 50% of the position as profit at 103.05 and leave the remainder of the position to run.

Risk 0.50% and the trade may be taken until 8am London time tomorrow.

USD/JPY Analysis

The pair fell very sharply on Thursday and continued its downwards move on Friday, closing very near its weekly low at the end of last week. The sharp, impulsive downwards move saw a break of a long-term bullish trend line that has existed since the triangle breakout in November and at one point this morning the price reached 101.90, approaching the remaining wider bullish trend line, as can be seen from the daily chart:

We may next have either a good long or short opportunity, as due to the violence of the breakdown it is hard to say where this pair will be going next. There should be a great support level at 101.63 which today happens to be exactly confluent with the GMT daily S1 pivot point, and also with the remaining long-term bullish trend line. Above us is the previous resistance which was briefly retested after the breakdown at 103.75, which may well act as good resistance should the price manage to get back there:

There is no important news due today for the JPY but there is for the USD: U.S. New Home Sales at 3pm London time.