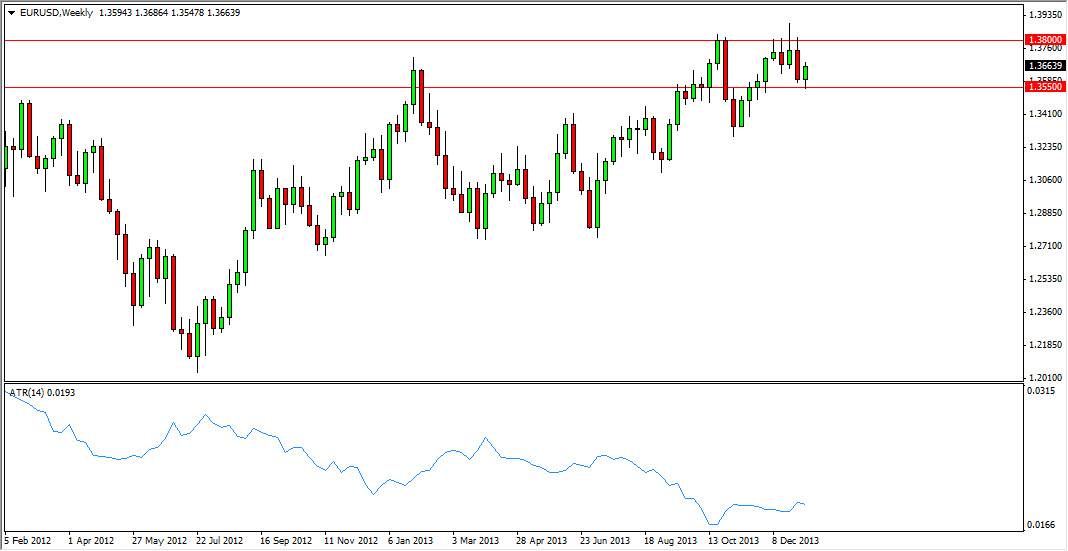

EUR/USD

The EUR/USD pair had a slightly positive week after initially falling down to the 1.3550 support level. This area caused a bit of a bounce, and as a result it looks like we’re going to continue to meander around in this general vicinity. However, if you look at the ATR, you can see that the market is becoming more and more stagnant, which suggests that we will see a significant move sooner or later. The question then becomes which direction do we head?

Looking at the chart, you can see that the 1.38 level is significantly resistive. That being the case, if we can break the top of the shooting star from two weeks ago, this market goes much higher. Probably heading towards the 1.40 level first, and then possibly even higher. On the other hand, if we break down below the 1.35 level, things could start to fall apart. All things being equal though, it’s possible that this market may need to grind sideways a little bit more before breaking out. The breakout should be a significant trading opportunity though.

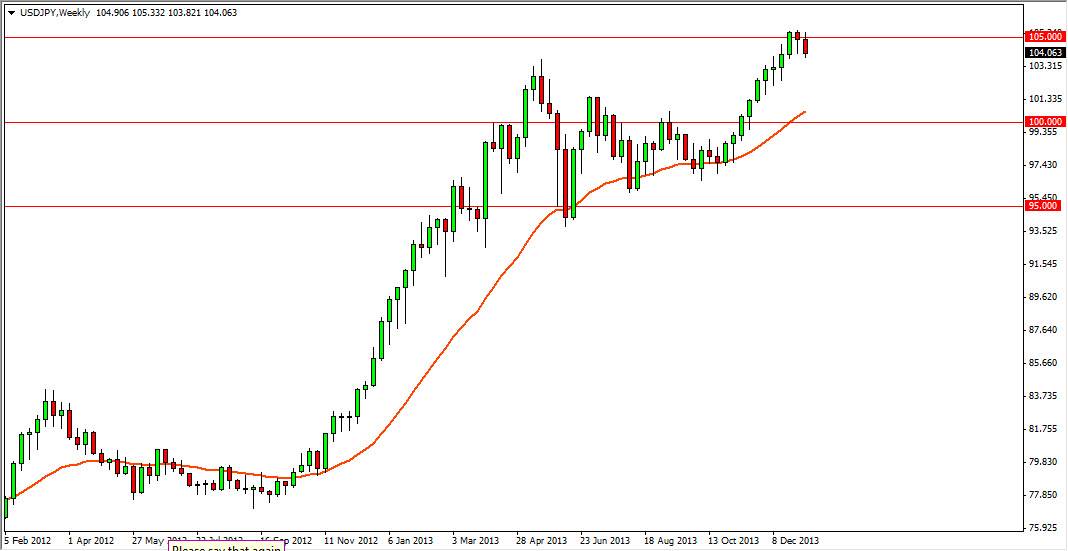

USD/JPY

The USD/JPY pair is a market that I have liked for some time now. That being the case, I feel that this market continues to go higher, but we may get a little bit of a pullback in the short-term. After all, you can see that we are a bit overbought at this point, and the last week was pretty negative based mainly upon the weaker than anticipated nonfarm payroll numbers. On this chart, you can see that I have the 26 week EMA posted, and that the market has followed the six month EMA quite nicely. Because of this, we could get a little bit of a pullback but I believe this will be a buying opportunity.

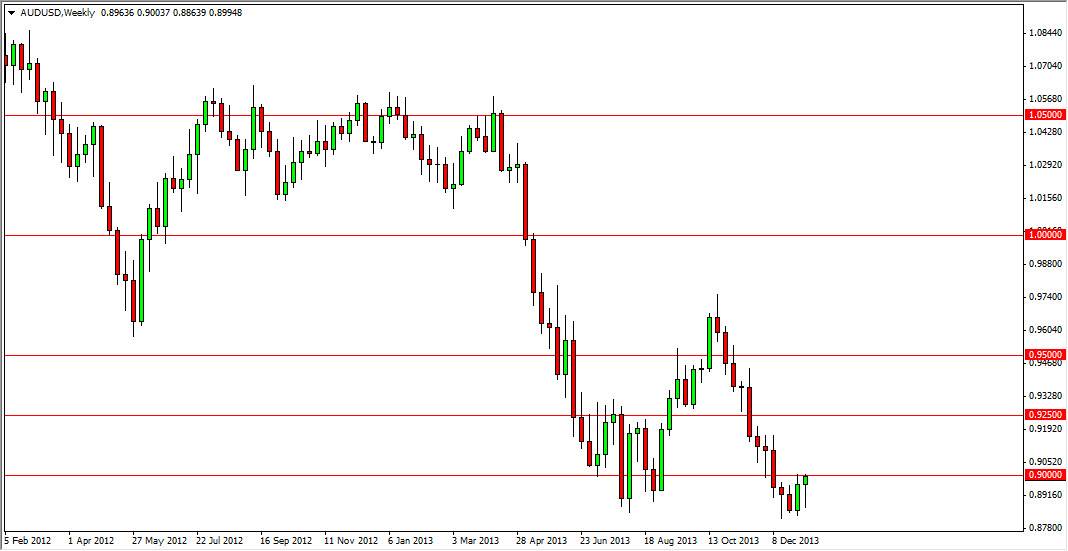

AUD/USD

The AUD/USD pair had an interesting week as it initially fell as per usual, but bounced enough to form a nice-looking hammer. This hammer sits underneath the 0.90 level, an area that is of course important based upon the large round psychologically significant aspect of it, but in the end I think this is a market that is still far too beat up at the moment to make significant gains for a long-term move. I believe that we will have a couple weeks of gains for the Australian dollar if we can get above the 0.90 level, but the 0.95 level will be far too strong for the Aussie, so we probably have a situation where we can go long for a couple of weeks, and then turn around and short it again.

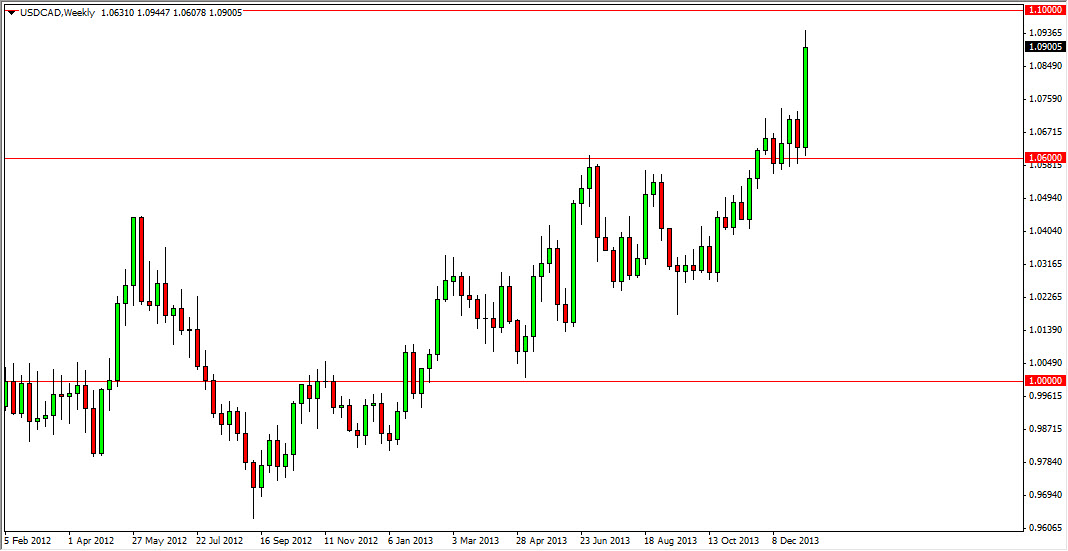

USD/CAD

The USD/CAD pair had a strong week as you can see, using the 1.06 level as a springboard to go much higher. This would been predicated upon the weaker than anticipated Canadian jobs numbers, which quite frankly were more of a disappointment than the ones we saw out of the United States. That being the case, this pair should continue to go much higher, especially considering that the oil markets are starting to fall apart a bit. I believe that we will hit the 1.10 level in the near term, but there could be somewhat of a pullback between now and then, which I believe is a nice buying opportunity.