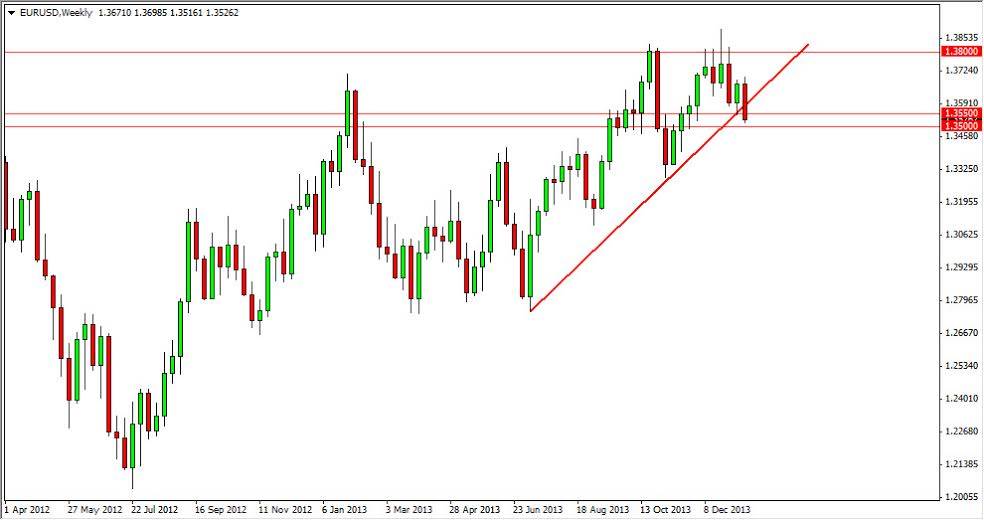

EUR/USD

The EUR/USD pair fell over the course of the week, braking below the trend line that the market has been following. The breaking below of the 1.3550 level for support suggests that the market is ready to sell off even further. The 1.35 level below has been supportive as well, and because of this, I feel much more comfortable selling below that level – perhaps on a daily close below the handle. If that happens, the 1.33 level will more than likely be targeted.

AUD/USD

The AUD/USD pair fell as well, and finally closed below the 0.88 level. This represents further weakness in my mind, and because of this I think the pair will continue to fall down to the 0.85 level without too many issues. The market will continue to favor the Dollar in my opinion, as I am seeing strength in the USD in several pairs. This should be the theme in general this next week, and the Aussie is without a doubt one of the weakest currencies of the G-10 at the moment.

USD/CAD

The USD/CAD pair tried to rally this week after a significant fall. The rally was enough to form a hammer-like candle, but still finds itself below the 1.10 level. This is an area that I had targeted in the past, and I think it will continue to offer resistance in the future. The market will more than likely get parabolic again if we break out, and with the way that the oil markets look right now – I expect it to in all honesty.

GBP/USD

The GBP/USD pair fell this past week, but found support at the 1.63 level in order to bounce and form a hammer for the week. The 1.65 level above has been rather resistive over the last month or so, but the fact that we couldn’t hang onto losses for the week has me thinking that the pair is going to break out sooner or later. This pair is the anomaly though, as the Pound is one of the few currencies doing well against the Dollar at the moment.