USD/CAD

The USD/CAD pair rose during the week in this market as the 1.10 level finally got broken above, and the resistance finally gave way. This was a major move in my estimation, and I think the pullback that the market showed late in the week isn’t much beyond a simply rest in the move higher. The 1.10 level should be supportive going forward, the buyers certainly picking it up there. After all, I have to wonder how many people are on the outside looking in now?

EUR/USD

The EUR/USD pair had a positive showing, but formed a shooting star on Friday. This suggests to me that the market is going to struggle going higher in the short term. However, the general consolidation area extends to the 1.38 level in my opinion, and as a result I think this market eventually moves to that level. Below, the 1.35 level offers significant support, and as a result I find this market to be very tight from a longer-term trader’s perspective.

USD/JPY

The USD/JPY pair fell during the week, and as a result I think the JPY might begin to gain in strength for the short-term. The 100 level below is obvious support, and as a result I think this is about as low as the market can go. However, the market looks as if the area between here and there has seen some buying, so it’s possible that we get the supportive candle before we get down to that area. The “handles” between here and there should offer support sooner or later.

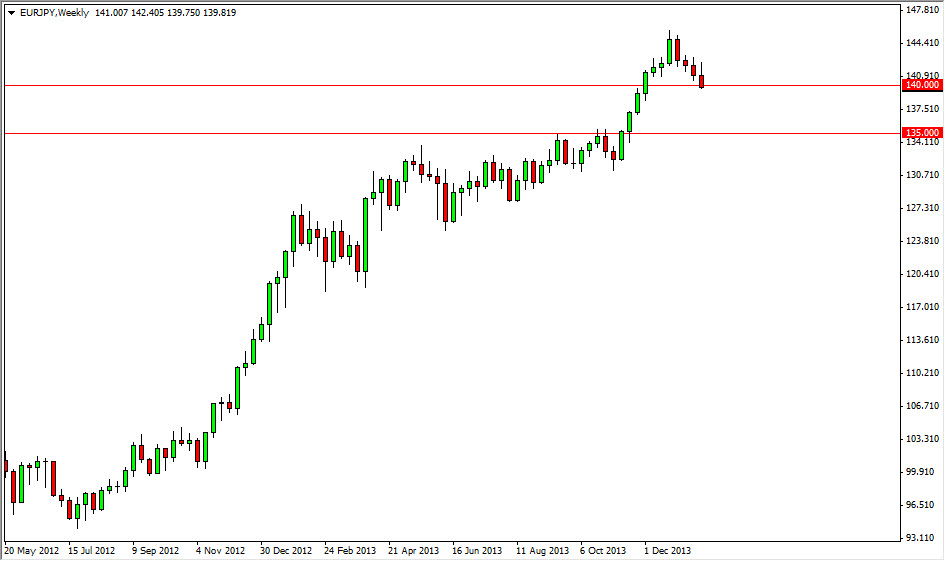

EUR/JPY

This pair is probably the most “easy” market to read at the moment for me. The pair tried to rally during the previous week. The area above offered too much resistance, and as a result we fell back down. This ended the week forming the shooting star that you see on the weekly chart, and because of this it looks as if the market is trying to fall a bit. The area down to the 135 level looks as if it could be easily sliced through. On a break of the bottom of this past week, I think it happens.