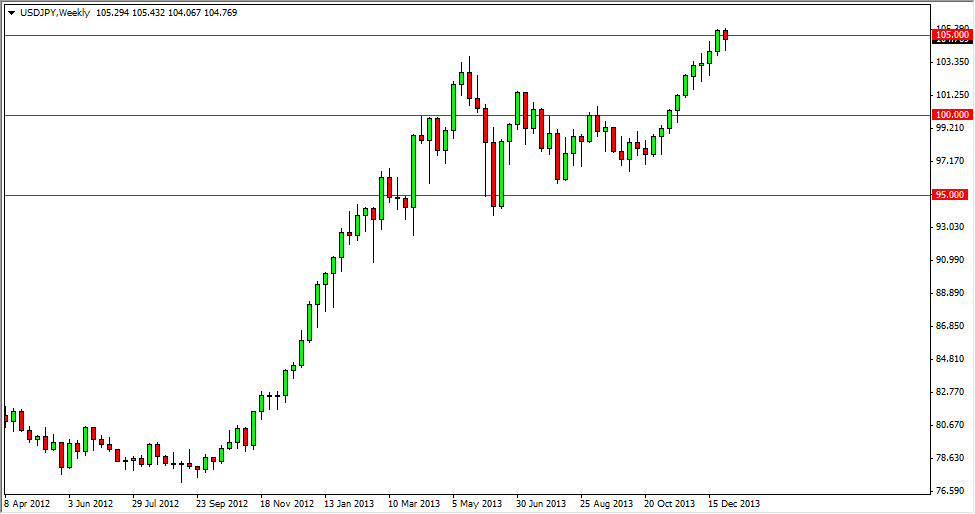

USD/JPY

The USD/JPY pair fell during the balance of the week, as the 105 level continued to attract trading in general. The pair still looks good though, and I believe that the market will eventually break higher in order to continue the uptrend. The Non-Farm Payroll report should cause the market to move drastically, and if the United States continues to add jobs at a decent clip, this pair will be moving quickly to the upside. If we do get some kind of pull back though, I am looking to buy on signs of support, under the guise of “value.”

EUR/USD

The EUR/USD pair tried to rally during the first part of the week, but found the 1.38 area just above to be far too resistive. The area pushed the market back down, and the candle ended up closing at the very lows. The market has far too much in the way of supportive areas below, and as a result I am not interested in selling at this point. I think the Non-Farm numbers will be essential as well, but the real move can’t be had until after we see if the US is adding jobs. A good number sends this pair lower.

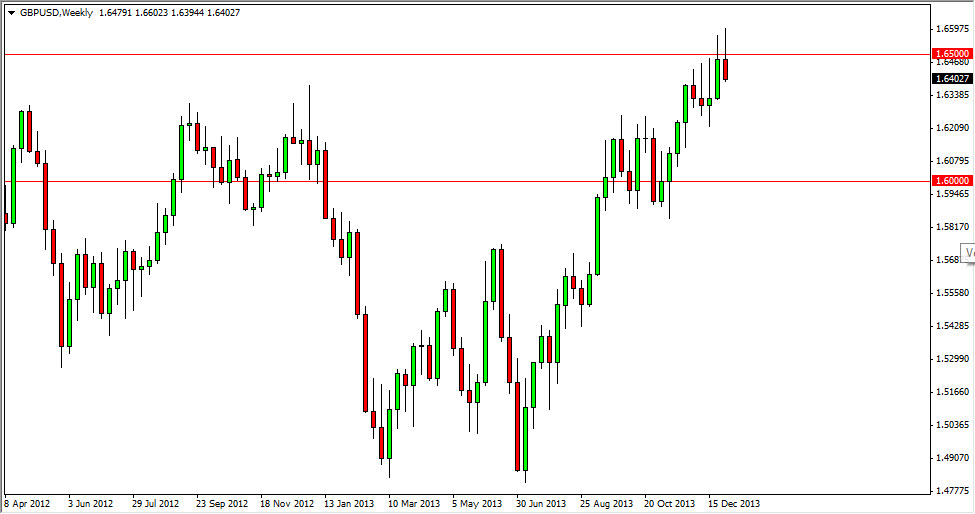

GBP/USD

The GBP/USD pair tried to rally during the week, but the 1.65 level offered too much in the way of selling. This pair looks like the EUR/USD in that sense, but this pair is certainly more positive overall in its appearance. The shooting star looks negative, and a pullback is probably coming. However, the pair looks like one I would want to buy on dips. Besides, the Pound has been strong against most currencies, and this pair won’t be any different – given enough time. The Dollar is strong too, so I suspect that this pair would be one that grinds higher more than anything else. Supportive candles below are how I am getting involved.

NZD/USD

The NZD/USD pair had a positive week, bouncing off of the 0.81 level again. This pair has been grinding sideways for a while now, but the market looks like it is trying to turn around in this area. The New Zealand dollar is highly correlated to the commodity markets, so I will be using this pair as a proxy for them. The market should look for 0.85 level eventually though, at least in my opinion.