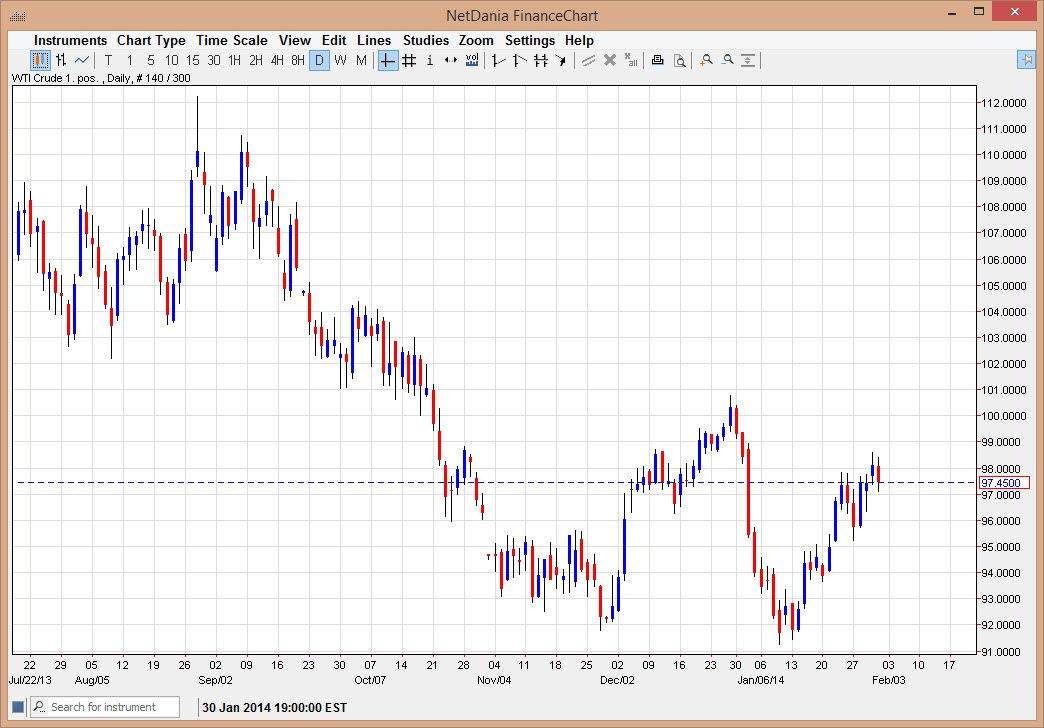

The WTI market fell during the session on Friday, testing the $97 level finding support at that exact area. We have recently broken out over the last 48 hours, so it makes sense that we would pull back to try and find more buyers. With this, I believe that we will attract more upward pressure and initially hit the $100 level over the course of the next several sessions. Certainly, the market has been bullish lately, and a little bit more of a grind than from here to $100 makes sense.

The momentum has been slowing down lately, but you would expect that as we have just approached a very noisy area on the chart from back in the early part of December. However, I am starting to wonder whether or not we had just seen a double bottom in this market, and if so for how long? After all, that is one of my favorite trading signals but it is not confirmed until we break the middle of the “W” pattern, which is at roughly $101. I think if we get above $101, this market starts heading towards the $110 level, albeit in a choppy manner.

Emerging markets.

There are a lot of concerns with the emerging markets right now in general, so we will have to see how that plays in the oil market. However, while the US dollar is strengthening it does put a little bit of a slowdown on any type of move higher in this market. Nonetheless though, that you don’t necessarily have to move as polar opposites, even though most people tend to think of it in that set of terms.

With that, pay attention to the jobs numbers out of the United States, which of course coming out on Friday. If the US is showing more strength, then you can imagine that most oil traders look at this as a potentially bullish scenario for energy in general, and especially petroleum which of course is used in abundance with heavy industry and transportation, both major parts of the US economy. As far as selling is concerned, I just see far too much noise to be bothered with it.